It’s that time of year again. Time to reflect on accomplished business and take steps to improve your market position by considering anticipated new trends. Like 2017, 2018 will not disappoint. Shifts in top trends will make this year a year of opportunity for brokers, as well a year of uncertainty. Setting yourself up for success starts with a plan. Here, we look at three small group trends for 2018 and suggest ways to adapt to them.

This Year’s Small Group Trends

1. More small employers will self-insure

There’s no denying it, more small employers are choosing to self-insure.

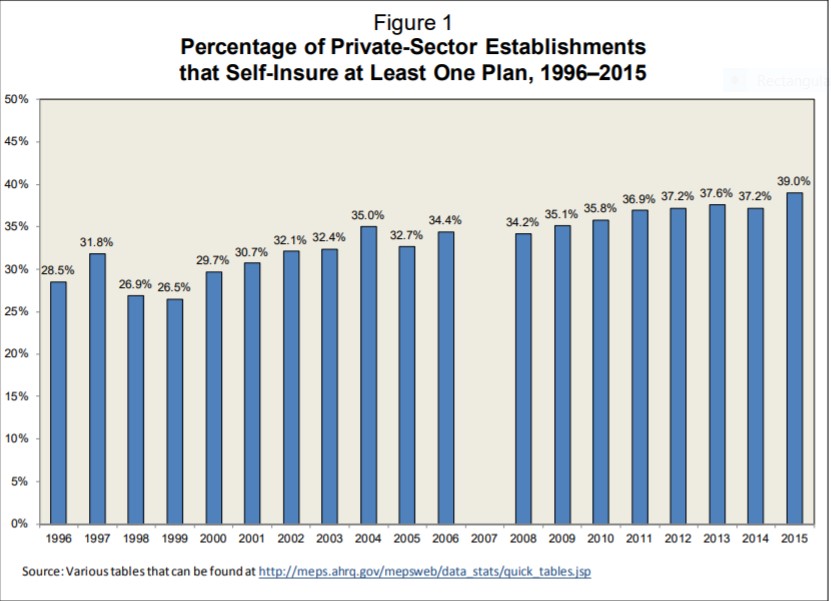

Data from the Employee Benefits Research Institute shows that the number of employers offering self-insured health plans rose from 28.5% in 1996 to 36.8% in 2015.

Since 2015, the number of employers self-insuring has continued to rise—the number of small employers self-insuring has increased by 7%, and the number of mid-size employers self-insuring has risen by 19%.1

This trend mirrors increases in the number of employees enrolled in self-insured plans. Since, 2013 there has been a 3% increase in the number of workers enrolled in self-insured plans.1

Data also confirms that companies with 25-999 employees are more likely to self-insure.1

So, why are employers opting to self-insure and how should you, as a broker, position yourself to do business with these companies?

Most companies opting to self-insure are self-insuring to avoid the high costs associated with fully-insured plans, which include unsustainable renewal rates.

They’re also opting to self-insure because many of the challenges traditionally associated with self-insured plans, such as finding and maintaining cash flow for claims, are being alleviated by brokers and carriers.

As a broker, adapting to this trend means:

• Telling clients about self-insure options. The number of clients who will ask about options to control costs will only increase. You’re better off being transparent with them and presenting all the options. Many brokers are beginning to operate using innovative compensation arrangements that make working with self-insuring clients possible.

For example, you can take your fee in a variety of ways—an annual fee, a per member fee, or a per month fee. These fees are associated with the administration of the self-funded plan, the stop-loss premium, or both. You could also take the more traditional approach and charge a commission on the stop-loss premium. Either way, the industry is moving this way, if you don’t adapt, you risk losing out. Brokers who save clients money are more in-demand.

• Helping clients transition to self-insured plans. Clients will need guidance navigating the transition to self-insuring. Guiding them toward selecting stop-loss insurers and underlying medical carriers that get along is, for example, an area where you can demonstrate your expertise and increase your value, because a poor match between these vendors can lead to several problems.

The self-insure trend may be different than what you’re used to, but it does offer opportunity. For example, helping your clients navigate their long-term strategy will strengthen your relationship with them. It also gives you an opportunity to demonstrate that you can think outside the box. And, as your client experiences beneficial outcomes, you become a trusted advisor—with more referrals and new leads for additional opportunities.

2. Reference-Based Pricing Will Grow

You guessed it—as self-insured plans rise in popularity so will reference-based pricing (RBPs) structures. Even large companies are moving toward reference-based pricing—with 13% already using reference-based pricing and another 18% considering it.2

Reference-based pricing offers an alternative to PPOs for self-insured employers. Because of the problems associated with PPOs, a larger number of employers are turning to reference-based pricing.

According to the Employee Benefit Research Institute, aggregate savings through reference-based pricing could be as high as $9.4 billion.3

Reference-based pricing will continue to stick around, more employers will probably look at using it, and brokers will need to adapt to this trend.

So, how should you adapt to this trend?

Here are a few suggestions:

• Be your client’s advisor when they’re ready to create an employee education campaign. Connect them to customizable marketing and education materials, and make sure they’re communicating everything they need to be communicating to employees. reference-based pricing models are heavily dependent on employee use and acceptance. Consequently, employee education is essential.

• Lead meetings where you review plan details and customize employee communication materials. The increasing adoption of reference-based pricing models is an opportunity for you to demonstrate your leadership skills and creative thinking.

• Act as an advocate. Address billing issues and be available to explain benefits and other areas that leave clients and their employees feeling uncertain.

• Help your client select a third-party vendor who can successfully handle reference-based pricing processes. The reference-based pricing model is newer, so you’ll want to make sure your clients are partnering with reliable vendors who have experience with this model.

• Navigate clients through ACA compliance issues. Reference-based pricing models necessitate close examination of ACA guidelines and rules. Acting as a trusted advisor in this capacity can strengthen your relationship with clients and generate additional work.

3. There will be an increase in association health plans

Businesses that do not move down the path of self-insuring and reference-based pricing and who have yet to capitalize on group insurance may take advantage of association health plans now that the individual mandate has been repealed.

Those who do take advantage of these plans will do so because of the benefits tied to them—group bargaining power, ability to form associations across state lines, and potential cost savings.

However, these plans are not new, and experts debate their value.

Proponents for the plans cite cost savings, but skeptics express concerns about insufficient funding, inadequate reserves, fraud, and discrimination.

Consequently, brokers should continue to approach these plans as they have in the past but keep an eye out for news about these plans.

Gearing Up Starts with a Reliable Partner

Your clients partner with you because you’re good at what you do. You advise your clients to partner with vendors they can trust. So, while working with your clients in the above mentioned way will serve you well, your first step should be partnering with a reliable partner—one that can support you!

We’re here to help, because like you, we know success starts with the selection of a reliable partner. Connect with us today to discuss your needs. We’ve got you covered when it comes to employee benefit solutions, benefit administration solutions, and more.

1. https://www.ebri.org/pdf/notespdf/EBRI_Notes_07-no7-July16.Self-Ins.pdf

2. http://info.brittongallagher.com/blog/how-does-reference-base-pricing-work-pros-and-cons-for-group-benefits

3. https://www.shrm.org/ResourcesAndTools/hr-topics/benefits/Documents/EBRI_IB_398_Apr14.RefPrcng.pdf