High deductible health plans (HDHPs) are becoming more and more popular. Currently 60% of employers offer an HDHP plan as an option, and 40% offer it as the only option. They also pair perfectly with HSA solutions. Given how much Health Savings Accounts offer, it’s completely understandable for employers to anticipate high participation rates. However, the reality is that most companies will experience only low to moderate participation rates. Only 50% of employees electing a HDHP choose to establish an HSA. Strong communication is key to increasing participation in HSAs.

These communication tips will help you raise employee HSA proficiency and boost enrollment.

1. Keep Explanations Simple

Employees tend to tune-out when HSA explanations involve complex jargon. The best way to increase HSA proficiency in the workplace is to explain HSAs like this: an HSA holds money you set aside to be available when you need help covering healthcare expenses—either because a deductible hasn’t been reached or because there’s an out-of-pocket expense.

2. Speak in Terms of Everyday Benefits

Tell employees how HSAs benefit them in real life. Workers are concerned about how they’re going to pay for their son’s braces or their daughter’s glasses. They want to know how they’ll afford their prescription and how they can save on filling their medicine cabinet. Explaining that an HSA can help cover every day medical expenses, including household items like Band-Aids, sunscreen, and cold medicine, is an excellent communication tactic.

It may also be helpful to create promotional materials that display these benefits and distribute them in the office. Promotional materials that tell a story are especially powerful. If there’s an employee who’s willing to share how an HSA helped them, incorporate their story in workplace marketing materials.

3. Share How Easy it is to Purchase Household Items with an HSA

Employees loves convenience and simplicity. Be sure to stress how easy it is to purchase household items with an HSA. Thousands of the household items covered by an HSA are available online at the HSA Store. If employees don’t want to go through the hassle of guessing which items are covered by an HSA at the grocery store or pharmacy, they can do all their shopping online at the HSA Store using their Clarity Ready for Life debit card. Everything in the store is 100% covered by an HSA, so there is absolutely no need to guess!

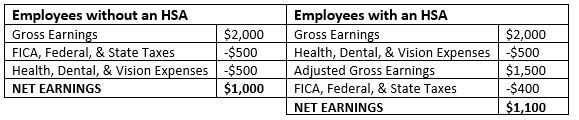

4. Explain Tax Benefits Using Visuals and Real-Life Examples

Taxes can be difficult for employees to understand—just look at how many people pay to have their taxes done for them. Show employees what having a tax-advantage looks like. Employees will instantly see the benefit of an HSA and will be more likely to sign up.

In this example, the person with the HSA account earns $100 more per paycheck!

5. Brag about Flexibility & Opportunities to Save with an HSA

Nearly 42% of employees have little to no savings and 47% have less than $1,000 in their checking account. Not only can an HSA prevent employees from incurring debt when an unexpected healthcare cost arises, it can match their lifestyle on a month-to-month basis because they can change their contribution amount as needed.

Plus, unlike FSAs, the savings that are left at the end of the year in HSAs are not forfeited. Employees can take what’s left and roll it into their retirement accounts tax-free! In this sense, an HSA could help employees wind up with an unexpected chunk of cash that they can contribute to a retirement savings plan.

6. Illustrate how HSAs Help Prepare Employees for the Unexpected

Employees that have their HSA with Clarity can take advantage of a unique payroll advance, the Ready for Life HSA. Employees who sign up for this HSA will receive overdraft protection at point of purchase and advance funds, if needed. This can help to cover large and unexpected medical costs. The advanced funds are paid back through small, automatic payroll deductions.

Aim for 100% Participation

Although a challenge, it is possible to increase participation in HSAs. All it takes is effective year-round communication. Host luncheons where employees learn about HSAs, distribute flyers throughout the office, and send emails. Also, take advantage of your HSA admin company’s resources. As long as you communicate the benefits of an HSA in a way that is easy to understand, employees will see their attractiveness and elect to participate.