As health savings accounts become more popular among employers and employees, setting clients up with a revolutionary HSA may be just what the doctor ordered.

As health savings accounts become more popular among employers and employees, setting clients up with a revolutionary HSA may be just what the doctor ordered.

The health savings account is approaching its fourteenth birthday this December and its popularity isn’t likely to decrease anytime soon. Passed into law during the Bush presidency, HSAs were established to help individuals covered by high deductible health plans save for medical expenses. The number of perks associated with the account—tax-advantages, individual ownership, balances that roll over, etc.—continue to drive enrollment.

Here, we provide an overview of the various trends in Health Savings Account (HSA) enrollment.

Key Takeaways

• Enrollment in HSAs is increasing

• Total HSA assets are growing

• HSA enrollment is highest among 45-64 year olds

• The attractiveness of HSAs drives employer adoption and employee enrollment

HSA Enrollment Trends

• Overall HSA enrollment is increasing

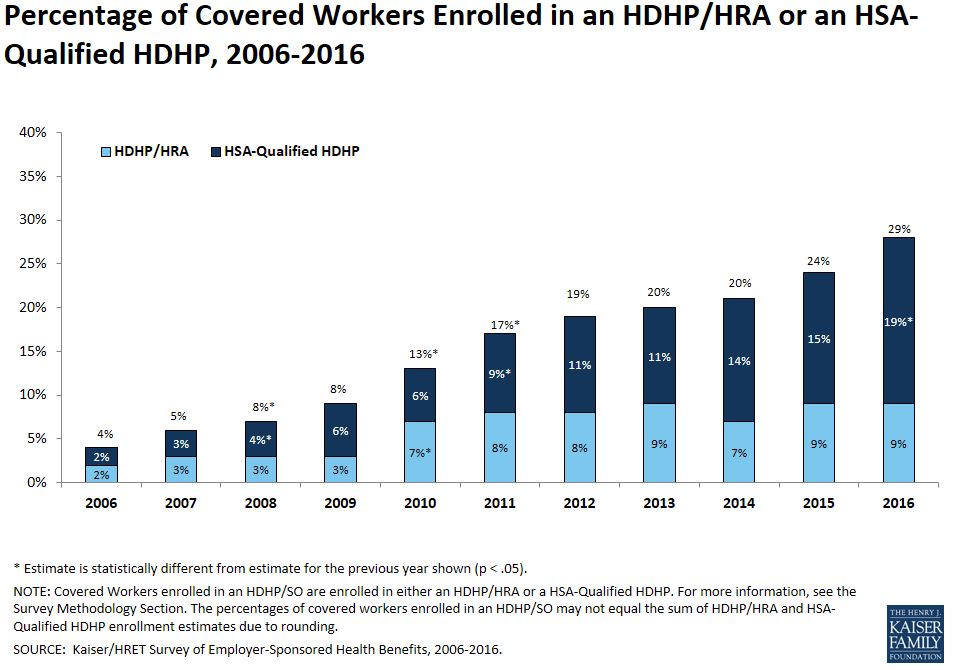

Enrollment data continues to highlight the steadily rising popularity of health savings accounts paired with qualifying high-deductible health plans. Research conducted by the Kaiser Family Foundation, using a pool of employer data, shows the number of employees enrolled in an HSA has risen by 17%, with a large jump in enrollment occurring in more recent years.

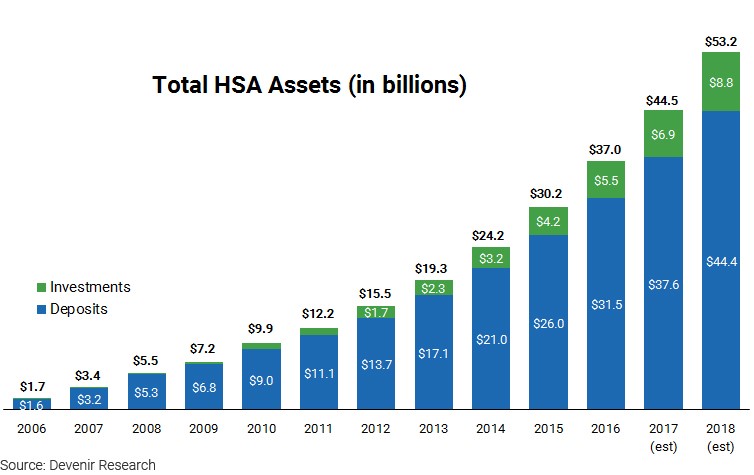

In addition, according to the Devenir Research Group, the number of HSA accounts has risen to 20 million within the last few years— a nearly 20% year over year increase. Altogether, these accounts hold approximately $37 billion in assets, a number that is likely to grow come 2018.

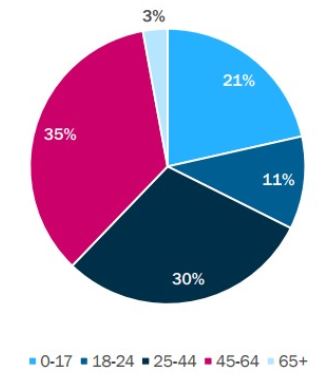

• Enrollment is highest among 45-64 year olds

HSA enrollment is highest among 45-64 year olds. Data collected from over 40 insurers indicates approximately 35% of HSA/HDHP enrollees were between 45 and 64. Health Savings Account enrollment is next highest among 25-44 year olds at 30%. About one-third of HSA/HDHP enrollees were less than 24 years of age. Few were over 65.

Age Distribution of HSA/HDHP Enrollees (Jan 2016)

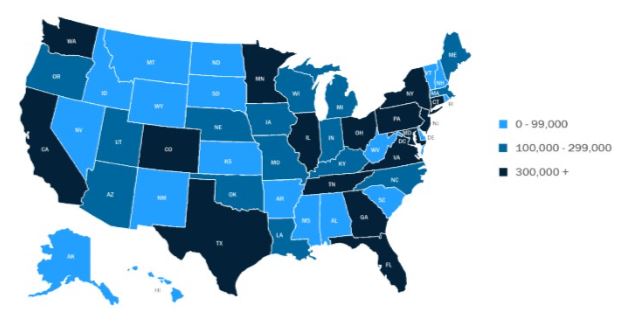

• Enrollment is Strong Amongst Coastal States (and Certain Inner States)

States with strong HSA enrollment include: Washington, California, Texas, Colorado, Florida, Georgia, Tennessee, Minnesota, Illinois, Ohio, Virginia, Maryland, Pennsylvania, New York, New Jersey, and Connecticut.

The 5 states with the largest reported HSA/HDHP enrollment were: Texas, Illinois, Minnesota, Ohio, and Florida, with Texas and Illinois reporting between 1 and 2 million enrollees.

Number of Enrollees in HSA-Qualified HDHP Plans by State (Jan 2016)

What’s Driving HSA Enrollment?

Why are HSAs becoming more popular? The answer is simple: HSA accounts offer tremendous benefits for employers and employees.

• Employers Benefits

In a world of competition and complex regulatory requirements, HSAs offer employers a way to attract top talent without damaging their bottom line. Employers are also able to choose whether or not they will contribute to employee HSA accounts, and any contributes made may be tax deductible.

• Employee Benefits

HSAs offer enrolled employees a way to save for inevitable medical expenses using pre-tax dollars. This means employers actually take home more money while saving for the unexpected. Not to mention there’s a triple-tax advantage associated with HSAs which is very appealing (contributions are made pre-tax, withdrawals to cover eligible medical expenses are not taxed, and interest and income generated from an HSA are tax-free.)

Also, young employees are realizing the value of being healthy and are opting for high deductible plans paired with an HSA. This combo lowers their monthly expenditures while offering a flexible way to save what they need for healthcare expenses. Plus, most employees like the fact that HSAs are individually-owned, meaning they can take the account (and what’s in it) with them when they change jobs. HSA accounts can also be used, in certain cases, to pay for COBRA plan premiums. More about this benefit can be learned at Clarity Benefit Solutions on our cobra administration services page.

Conclusion

HSAs and assets seem to be rising steadily since the accounts became available to consumers in 2005. The attractiveness of HSAs to employers and workers will likely continue to drive employer adoption and employee enrollment in the years to come. Connect with a benefit administrator to learn about HSA administration options today.