Although good employees are typically dedicated to their jobs, their first priorities are always their families. While some employers may think that offering basic benefits through an HRA company is enough to help employees keep their families safe, sometimes unexpected incidents can bring medical costs outside the range of typical health insurance. Employers can do more to help employees keep their families safe, even when life throws curveballs.

Celebrating What Means the Most

July 8th is Family Day--a day to reflect on how much family means. It’s also a great time for employers to assist their employees in protecting the one thing they love the most. Employers can leverage Family Day to spark a conversation about keeping employees and their families covered for medical expenses, even when the unexpected happens.

Typical HSAs Only Go So Far

HSAs can help families pay for qualified medical expenses as needed, making them a good option for those who have intermittent medical needs. Making regular contributions can also help families prepare for the future and have an emergency fund to fall back on.

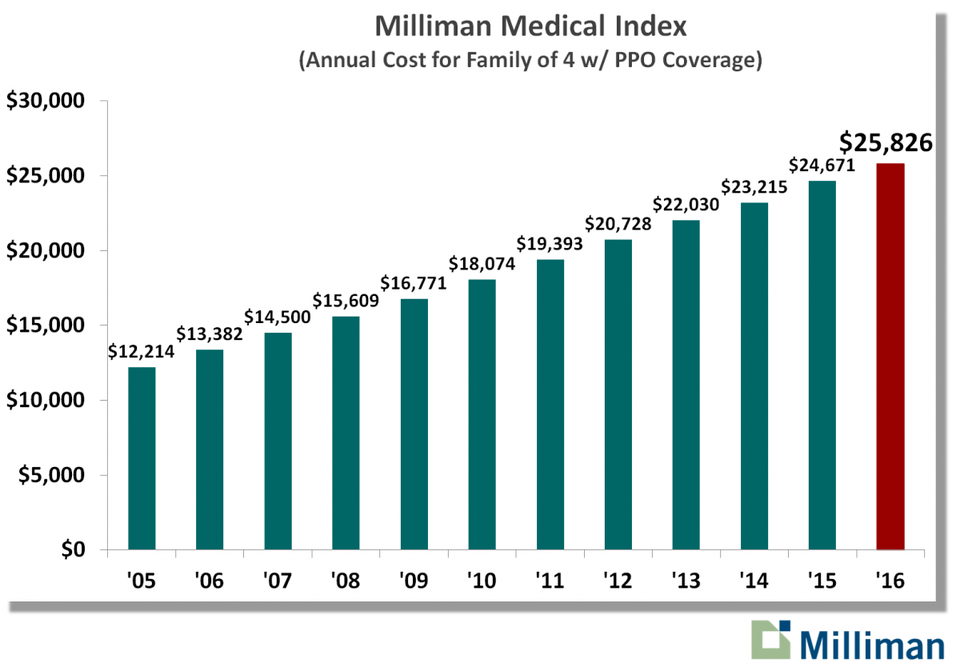

However, the cost of healthcare, especially for families, can be significantly higher than HSA balances. As of 2016, the average cost of family healthcare was over $25,000:

Built in Protection for Life’s Twists and Turns

HSAs seem like the perfect solution--until the unexpected happens. If your child gets hurt during a sports game, your spouse needs an emergency surgery, or you are diagnosed with a serious illness, there may be costs far greater than your HSA balance.

Clarity’s Ready For Life helps your employees prepare for the unexpected. With an interest-free, instant payroll advance (you set the limit), your employees can just swipe their Ready For Life Debit Card and access the funds they need without having to approach you and ask for it. The funds are then automatically taken out of future checks in manageable amounts (also set by you) until the full balance is restored.

An Advantage Families Can Appreciate

Ready For Life’s unique structure makes it possible for employees to support their families instantly, in the moments where it really matters. There are no ugly consequences to deal with; no outrageous credit card or lender interest rates. Your employee’s only concern in the aftermath of the medical emergency is taking care of their family.

Ready For Life lets your employees handle already difficult situations without added stress. This helps you provide the necessary support to your employees while knowing you are controlling costs and getting the money back over time.

Start the Conversation

“Ready For Life” is not just the name of the program, but the overarching theme your company’s benefits should provide for your employees. While no family moves through life without medical expenses, Ready for Life offers the opportunity to focus all attention on caring for and supporting one’s family, rather than worrying about where medical expense funds will come from.

Use Family Day to have a conversation with your employees about protecting what means the most to them. Show them how Ready For Life can be the safety net they need to protect them from life’s unexpected twists and turns. Contact us to learn more about health reimbursement account administration, providing the best options to your employees, and more.