Effective January 1, 2019, the Affordable Care Act’s individual mandate will be repealed. Individuals (who do not meet exemption criteria) will no longer face a tax penalty for not enrolling in minimum essential coverage.

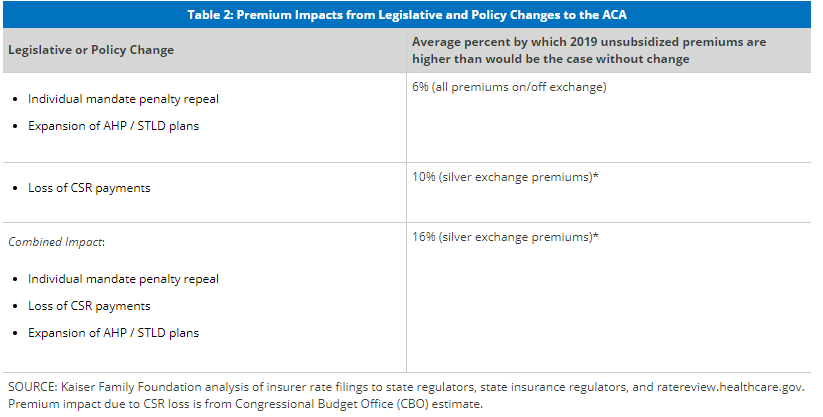

This change goes beyond just eliminating a tax penalty—it changes the whole landscape of health insurance. It’s predicted that as many as four million fewer people will buy insurance, which could lead to up to a 10% increase in premiums. Here are some predicted changes:

So what does this mean for everyone who needs coverage?

As an employer, you can take a proactive role in educating your employees about healthcare changes and help them make the best decisions for them. Here are some key points to keep in mind:

It’s still important to urge your employees to get health insurance.

Since people are no longer penalized for not buying health insurance, some people would be inclined to forego coverage. However, this can be an extremely risky move. Those without coverage are far more likely to either not get medical care that they need. Those that do could face staggering out-of-pocket expenses.

It’s important to urge your employees to get health insurance, even if they think they can survive without it. Even if participating in a plan through your company is not the best option for them, you should still encourage them to purchase health insurance of some sort. Having employees who are healthy and not facing the stressful burden of unexpected medical costs are going to perform more efficiently at work. Also, showing your employees that you genuinely care for their well-beings improves engagement and loyalty, improving your overall relationship with your employees.

Things to educate your employees about.

For some people, their experience getting health insurance through your company might be their first experience ever. HR professionals should be a reliable resource for people who need assistance with health insurance education.

Between the Affordable Care Act, state marketplaces, federal marketplaces and more, people have more choices than ever when it comes to health insurance options. Here are some items that you should definitely educate employees about:

Total cost. Figuring out exactly how much you will pay for healthcare in a given year isn’t necessarily possible, but using general health trends can help employees figure out what plan is best for them. Some plans have lower premiums, but higher deductibles, which could lead to a higher out-of-pocket cost depending on what medical care they receive. Have employees estimate their primary care, prescription, and emergency care needs for themselves and their dependents to help them pick the plan that best fits those needs.

Plan types and networks. There are many different plan types that operate within different networks. Depending on what kind of doctors and coverage your employees need, they would be best suited with different plan types. Since there are so many different options, it’s important to do research so you can help your employees. If you need further assistance, consider using a trusted broker as an additional resource.

Sources:

https://www.healthcare.gov/fees/fee-for-not-being-covered/