As older employees leave the workforce, they are often faced with a number of drastic changes and impactful changes to consider. One of the most important things to consider as they enter the next phase of their lives is what their financial planning looks like.

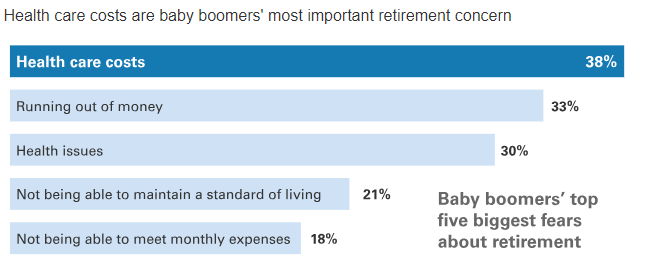

As the baby boomer generation approaches retirement, there are their biggest financial concerns:

Source: https://institutional.vanguard.com/VGApp/iip/site/institutional/researchcommentary/article/InvResRetireHealthCosts

For many retirees, healthcare needs will increase quite a bit in the upcoming years, so that adds to the fear of running out of money as time goes on.

What benefits your clients offer impacts employees through retirement just as much as it does during employment. Here are some retiree healthcare trends that employers can consider as they build their benefits offerings; that way, they can continue to assist their employees throughout retirement.

The need for additional savings

Pensions seem to be a thing of the past as more companies opt for 401(k)s. While some employers contribute to these accounts, some do not; therefore, it’s not likely that a 401(k) will provide enough money to last through retirement.

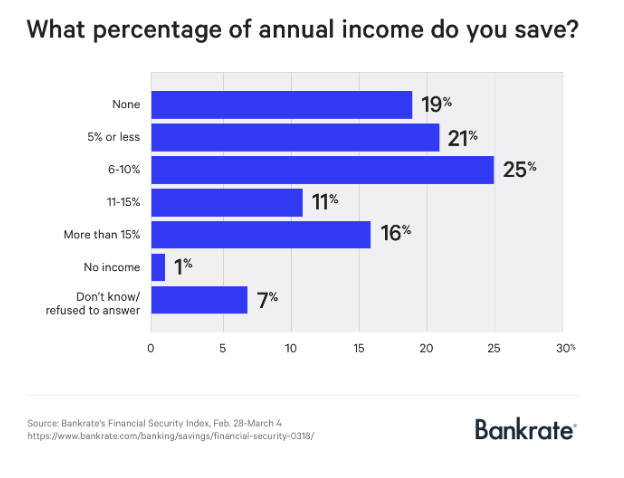

That, paired with the shaky state of Social Security, breeds a need for retirees to have either additional savings accounts or streams of income. Given the current state of peoples’ savings habits, this could be a concern:

Including financial wellness tools as part of your benefit offerings can help employees save enough money to feel comfortable going into retirement. Some tools you can offer:

- Financial planning and investment seminars

- Access to mortgage brokers and tax preparation professionals

- Access to budgeting tools and financial assistance

The rising cost of retiree healthcare

The most current projection is that retiree healthcare costs are estimated to increase 4% annually, which is higher than the general inflation rate. If that stands true, retirees will see majority of their retirement savings go to healthcare.

Encourage employers to offer additional coverage to supplement Medicare, especially since Medicare does not provide prescription drug coverage. Relying solely on Medicare can be extremely risky as people age and have increasing medical needs. Employers should take the responsibility to educate their employees and help them use their financial resources to plan accordingly.

HSAs as a retirement savings method

A growing trend that has been underutilized in the past is using a Health Spending Account (HSA) as a resource for retirement savings. Funds contributed into an HSA can be used towards eligible medical expenses into retirement. Since the money continues to grow tax-free within an HSA, it is a good way to grow funds. Additionally, the presence of an HSA account does not interfere with Social Security or other retirement benefits.

Employers who do not currently offer HSAs should start, as they benefit employees during employment and into retirement. Make sure your employees get the proper training and communication on the underutilized advantages of HSAs, such as the ability to invest contributed funds. Urge them to contribute the maximum if possible during employment, so that they have a bigger nest egg during retirement.

Sources:

https://www.healthaffairs.org/doi/full/10.1377/hlthaff.21.6.169

https://www.financial-planning.com/news/what-will-health-care-costs-do-in-retirement

https://institutional.vanguard.com/VGApp/iip/site/institutional/researchcommentary/article/InvResRetireHealthCosts