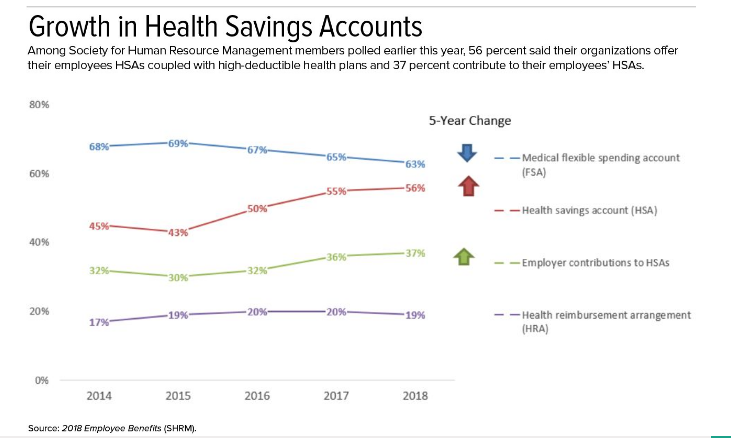

On July 23, 2018, two HSA-related bills (H.R.6199 and H.R.6311) were approved by the House Rules Committee. They underwent final passage vote on the House floor on July 25th, and were both passed. The bills will move to the Senate for consideration towards the end of 2018.

According to the House Rules Committee, these bills “will work to increase healthcare choices and provide more affordable options for families.”

Here are summaries of each bill and the changes they propose.

H.R.6199

Renamed: The Restoring Access to Medication and Modernizing Health Savings Accounts Act of 2018.

This bill proposes changes to the contribution and qualification laws for Health Savings Accounts (HSAs):

- Modification of Direct Primary Care Service Arrangements as to not count as a health plan that would disqualify someone from contributing to an HSA. Further, HSA funds could be used tax-free to pay for DPC arrangements, under certain limits.

- Allowance of certain health care services to be given at on-site or retail clinics without disqualifying an individual from contributing to an HSA.

- Allowance of contribution to an HSA if the individual’s spouse has an FSA in certain circumstances.

- Allowance of terminated FSAs and HRAs to be converted to HSA contributions.

- Reversal of the Affordable Care Act’s requirement for a prescription for reimbursement of over-the-counter medicines from HSAs, FSAs, and HRAs.

- Inclusion of menstrual care products as a qualified medical expense.

- Inclusion of certain qualified sports and fitness expenses to be considered qualified medical expenses.

H.R.6311

Renamed: The Increasing Access to Lower Premium Plans and Expanding Health Savings Accounts Act of 2018.

This bill proposes change that reduce restrictions on access to low premium plans and HSAs:

- Removal of the $500 limit for FSA year-to-year rollover.

- Allowance of working seniors enrolled in Medicare Part A to contribute to an HSA.

- Increase in the HSA contribution limit.

- Allowance of HSA funds to be used tax-free for certain expenses incurred before starting the HSA.

- Acknowledgement of Bronze and Catastrophic plans as HSA-qualified plans.

- Delaying of the re-imposition of health insurer taxes for another two years.

Although we won’t know the final ruling on these bills until later this year, it’s important to know what implications they carry.

By understanding the possible changes that can happen to HSA plans, everyone can be better prepared to offer employees accurate information and comprehensive support.