By necessity and choice, more workers are enrolling in high deductible health plans (HDHPs). But, are those plans good for workers?

The answer is: yes and no. An HDHP will lower monthly premiums, allowing employees to take home a larger monthly paycheck. But, if workers aren’t enrolling in an HDHP-qualified HSA, or aren’t contributing enough to their HSA, they are vulnerable to the unexpected medical expense.

Here, we take a look at the high deductible health plan pros and cons. We then look at data and identify ways to minimize the risks associated with HDHPs. Our benefits solutions offer an opportunity to make HDHPs great for workers and employers.

HDHP Advantages

The best high deductible health plan has several reasons to attract workers. Workers will typically see the following benefits with an HDHP:

• Lower monthly premiums (translation: more take home pay)

• Opportunity to save money if you rarely use health benefits

• Options to save for out of pocket expenses with an HSA (pre-tax contributions means workers take home more money)

Disadvantages of High Deductible Health Plans

On the flip side, disadvantages associated with HDHPs include:

• High out of pocket expenses for those with chronic illnesses

• High deductibles (translation: workers will need to spend significant amounts of cash on prescriptions, office visits, diagnostic tests, and more before their insurance kicks in)

• Large unexpected medical costs may cause workers to incur debt or overdraw their checking accounts if they do not have enough in their HSA to cover the expense and have not reached their deductible

The Data

The good, the bad, and the ugly—understanding how HDHPs impact workers starts with the stats.

• Workers save an average of $150/month and $1,800/year with an HAS-Qualified HDHP1

• Employees making less than $50,000 are less likely to establish an HSA after enrolling in an HDHP

• HDHP-Qualified HSA accounts are more attractive to higher-income people who can afford to fund an HSA

• 30% of those with HDHPs are age 25-44 and 38% are over 452—while younger employees may not need to visit the doctor as much, this may or may not be true for older workers

As the data indicates, for some workers, such as those with high incomes, HDHPs are smart choices— with an HDHP, these workers bring home larger checks, enjoy a bigger tax benefit, and have money set aside for medical emergencies. For most other workers, HDHPS are problematic. Because of low incomes and limited savings, many workers will experience a financial gap between their HSA balance and their deductible responsibilities.

Given that HDHPs aren’t going away anytime soon, perhaps the question we should be asking is: how do we make HDHPs work for all workers?

Making HDHPS Good for ALL Workers

HDHPs are already saving workers money by carrying lower monthly insurance premiums. The trick is to protect HDHP-enrolled workers from the unexpected medical expense in the event they don’t have enough money in their HSA and they haven’t reached their deductible. Making HDHPs good for all workers to show employee appreciation starts with the right HSA or an HRA.

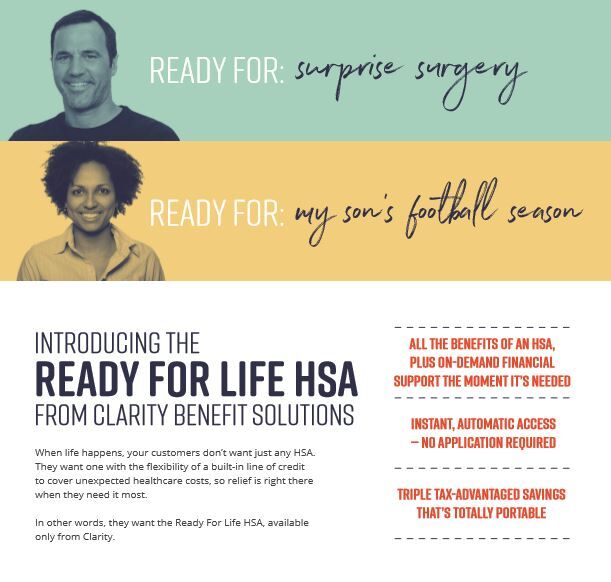

Ready for Life HSA

The Ready for Life HSA protects workers from getting caught in the gap between their deductible and their HSA. It offers all the benefits of a standard HSA and the option of a built-in payroll advance to cover unexpected expenses for workers caught in the gap.

It works like this:

1. An employee has a medical expense but not enough money to cover it

2. He or she receives the interest-free payroll advance and pays for the expense without using their credit cards or overdrawing their checking account

3. A payroll deduction is generated

4. He or she pays back the advance in small, manageable chunks

Not only does the Ready for Life HSA solve the challenges associated with HDHPs for workers, it benefits employers too. Employers have control. They get to decide who is eligible for an advance, how much will be advanced, the terms of the payback, and what to do with a terminated employee with a balance. It also allows employers to save on their healthcare expenses—with HDHPs that are good for all workers, employers can continue offering consumer-driven HDHPs with greater confidence.

Health Reimbursement Arrangement Plan (HRA)

The Health Reimbursement Arrangement Plan is another option that can be used to protect workers enrolled in an HDHP from the unexpected. This plan helps workers pay for out-of-pocket medical expenses such as deductibles, copays, and expenses not reimbursed by insurance. It allows employers to continue their reliance on consumer-driven healthcare plans and offers them greater control over funds. Common plan designs include:

First Dollar Coverage HRA: HRA covers first dollar health deductible until the HRA is exhausted

HRA with Employee Deductible: Workers must hit an out-of-pocket limit before the HRA kicks in. After the HRA kicks in, the plan will cover future deductible expenses until the HRA is exhausted

Percent-Based HRA: HRA reimburses employees for a percentage of healthcare expenses until the HRA is exhausted

Interested employers can learn more about HRA plans through their HRA company. Our health reimbursement account administration makes implementing and managing an HRA easy.

Making HDHPs GREAT for Everyone

So what is the best high deductible health insurance plan? More than four out of ten employers will begin to offer HDHPs in the coming years and with more employers likely to follow.3 While this trend affects workers differently, having both positive and negative effects, it is possible to make HDHPs great for all workers, putting an end to the question are HDHPS good for workers. And, it all begins with the right HSA or HRA.

1. https://www.nytimes.com/2016/11/01/business/is-high-deductible-health-insurance-worth-the-risk.html

2. https://www.ahip.org/wp-content/uploads/2017/02/2016_HSASurvey_Draft_2.14.17.pdf

3. https://healthpayerintelligence.com/news/high-deductible-health-plans-dominate-employer-offerings