National Purple Heart Day is just around the corner and there is no better time to revisit health care options in the veteran community. Why? As many probably know, the Purple Heart is awarded to veterans injured in the line of duty. It is awarded for great personal sacrifice, a sentiment many veterans share. While serving on active duty, service members and their dependents are fully covered, but what happens when they leave their service? Depending on the nature of that service, disability status, income, and other factors, a veteran may or may not qualify for adequate assistance from the government to meet their health care needs. Sacrificing for freedom shouldn’t mean sacrificing health care. Make sure your veterans know their options!

Popular Veteran Benefits

While veterans do have access to extensive benefit programs, their needs are hardly being met. Much of this is because VA benefits are incredibly finicky. Why? Veteran benefits have been gradually incorporated over decades. As a result, the definition of “veteran” varies from benefit to benefit. This creates a system that makes each veteran’s case unique and circumstantial. Hence the need for outreach from experienced brokers.

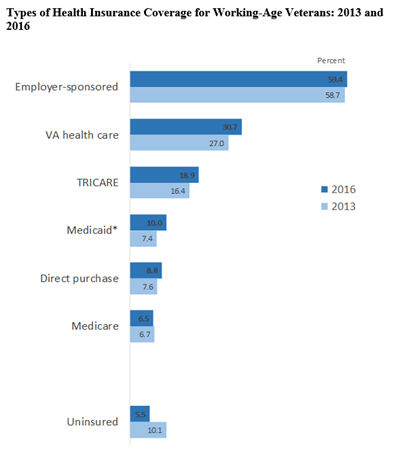

Figure 1: https://www.census.gov/newsroom/blogs/randomsamplings/2017/09/healthinsurancecov0.html

The figure above illustrates how many veterans seek their benefits through employers and utilize the VA health care program as supplemental safety net coverage. There are many reasons for this, but ultimately, there is an evident need for specialized benefits these veterans are not getting from VA. Some of these benefits important to veterans are:

- Dental

- Vision

- Life Insurance

Comprehensive Dental

Upon separating from military service, veterans are no longer eligible for coverage. Retirees do have a separate program to enroll in with a larger premium for themselves and a spouse. However, this program does not offer the same value as active-duty service does. So, when tailoring a program to your veteran workforce, it is important to understand their need for an appropriate dental plan. The better it is, the more it resembles their time in service.

Vision Focused on Eyewear

Even while in service, comprehensive vision care is not necessarily available. For contact lenses and many glasses frames, the active-duty service member was paying quite a bit out of pocket. Paying for examinations and various procedures in the eye care world will be jarring for them. Building a product that includes low-cost routine examinations and restriction-free lenses/frames co-pay is the best way to reach them.

Life Insurance for Security

While serving, servicemembers have access to a host of life insurance benefits for the well-being of their dependents. Upon exiting the military, these benefits are lost. Retirees can enroll in a fairly expensive Survivor’s benefits package that would effectively transfer benefits to a qualifying spouse. However, for other veterans, this is unavailable. Especially during the observance of Purple Heart Day, it is important to reach out to veterans about their families and what protections they have in place.

With National Purple Heart Day right around the corner, reaching out to your veteran workforce to offer your gratitude - and a helping hand with employee benefits information - is sure to be appreciated. This is a great method to connect with your clients and go above and beyond normal broker-client relations. Get familiar with their options, give them an advantage in addressing their insurance needs, and be sure to thank them for their service.