With many businesses holding open enrollment in the fall, now is the perfect time to make sure the employers you work with are able to debunk common health savings account myths. Become an indispensable resource this year by helping your clients effectively promote HSAs. Here are five of the most common HSA myths you’ll want to clear up with employers as they begin marketing their HSA option to employees.

1. HSAs are hard to access when you need to use them. This is definitely not true. In fact, most employers connect their employees with online resources that make it very easy to access and manage an HSA. For instance, the Clarity Smart Debit Card allows HSA account holders to easily access their account by swiping their card at the point of purchase. HSA participants can pay for expenses using the card as easily as they’d pay for gum at the grocery store. Plus, the Clarity Online HSA store makes it simple for employees to purchase a qualifying product without worrying about whether they can use their HSA account for the purchase—all items qualify.

2. If you don’t use the money in your HSA you lose it. This is a very common misconception. A major benefit of an HSA is that it’s individually owned. This means that the employee owns the account. They take it with them to a new job, change what they contribute at their leisure, and decide what they do with funds leftover in the account. Bottom line: the money that’s in the account is the employee’s and they don’t lose what’s unused.

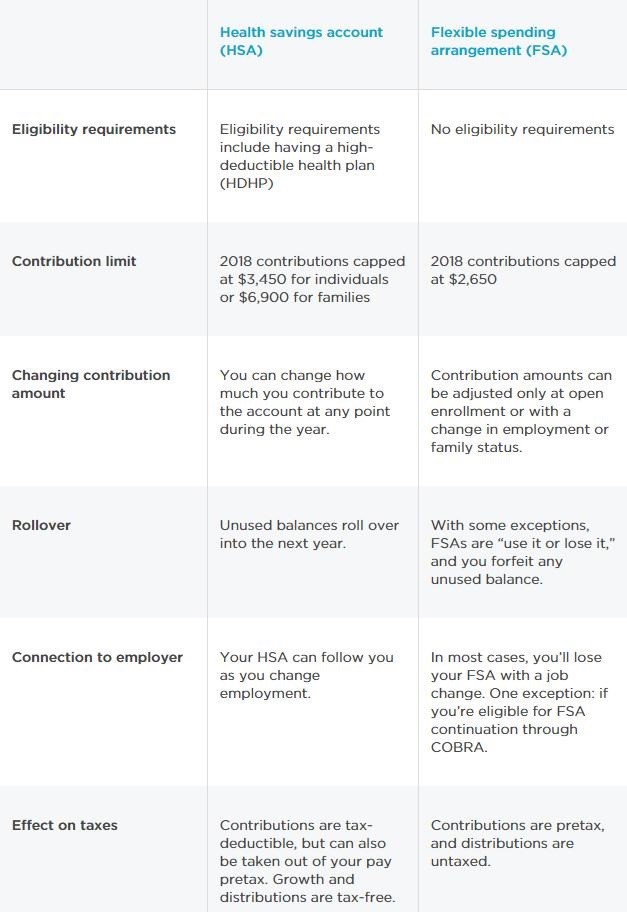

3. HSAs are basically the same as FSAs. This myth is commonly associated with the second misconception in this list, because unlike HSAs, FSAs usually operate on a use it or lose it basis. But, the accounts are actually quite different, as evidenced by the chart below.

4. HSA-HDHP plans are only beneficial if the enrollee doesn’t plan on having many medical expenses. Unfortunately, employers often inadvertently propagate the misconception that HSAs are best for young healthy people who don’t plan to use all their medical benefits. However, spreading this myth means a wide array of employees miss out on a potentially excellent opportunity. HSAs are attractive options to both young and mature employees for valid reasons.

Case in point: HSAs offer a triple tax advantage. Contributions are made pre-tax, interest earned is tax-free, and withdrawals on qualifying medical expenses are tax-free. These accounts enable employees of all ages to elect plans with lower monthly premiums and save for medical expenses. At the end of the day, employees could actually pay less with an HDHP-HSA than with another type of plan if employers contribute to the HSA. Not to mention, HSAs make it possible to pocket more take home pay.

The attractiveness of the HSA across the lifespan is supported by HSA enrollment figures which are split into fairly even thirds. Approximately a third of enrollees are between the ages of 0 and 24, nearly a third are between 25 and 44, and about a third between 45 and 64.1

5. HSAs can be used for your kids too. While most of the myths we’ve dispelled so far reveal answers that are likely to be viewed positively among prospective HSA enrollees, this particular myth is one area where employers need to make sure they communicate clearly to their employees because there are some technicalities which may upset employees if they’re not executed properly from the start. Basically, parents and guardians can only use an HSA to make purchases or pay for qualifying expenses on behalf of their children if they claim them as dependents on their tax forms.

Preparedness & Knowledge are Key

HSAs are a great option for several reasons. Help your clients to promote these savings tools accurately. Employees who receive accurate and easy to digest information are happier employees. Happier employees make happier employers and that means happier clients for you. For more information on how to communicate HSAs, read our post “Educate Like an Expert: Communicating HSAs to Employees.”

1. https://www.ahip.org/wp-content/uploads/2017/02/2016_HSASurvey_Draft_2.14.17.pdf