Brokers in the health insurance industry have seen more than enough chaos over the past few years. So, why should you be optimistic this year? Simple. As new tools, technologies, and benefits emerge, employers will turn to you for help.

1. Employers will need more help managing healthcare costs

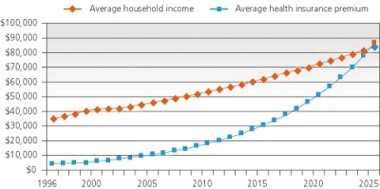

Healthcare premiums feel very out of whack to both employers and employees. Employee wages are not rising fast enough to account for increasing healthcare costs and employers are struggling to find ways to cover larger premiums.

If left unchecked, individuals, families, and employers will face big problems in just a few short years as many will no longer be able to afford quality healthcare.

This would seem like a disaster…if brokers weren’t around.

Brokers have a phenomenal opportunity ahead; they can prevent healthcare from becoming something only their wealthiest clients can afford and save thousands of individuals and families from the perils of poor or nonexistent coverage in the process.

2. More employers will want help with voluntary benefits

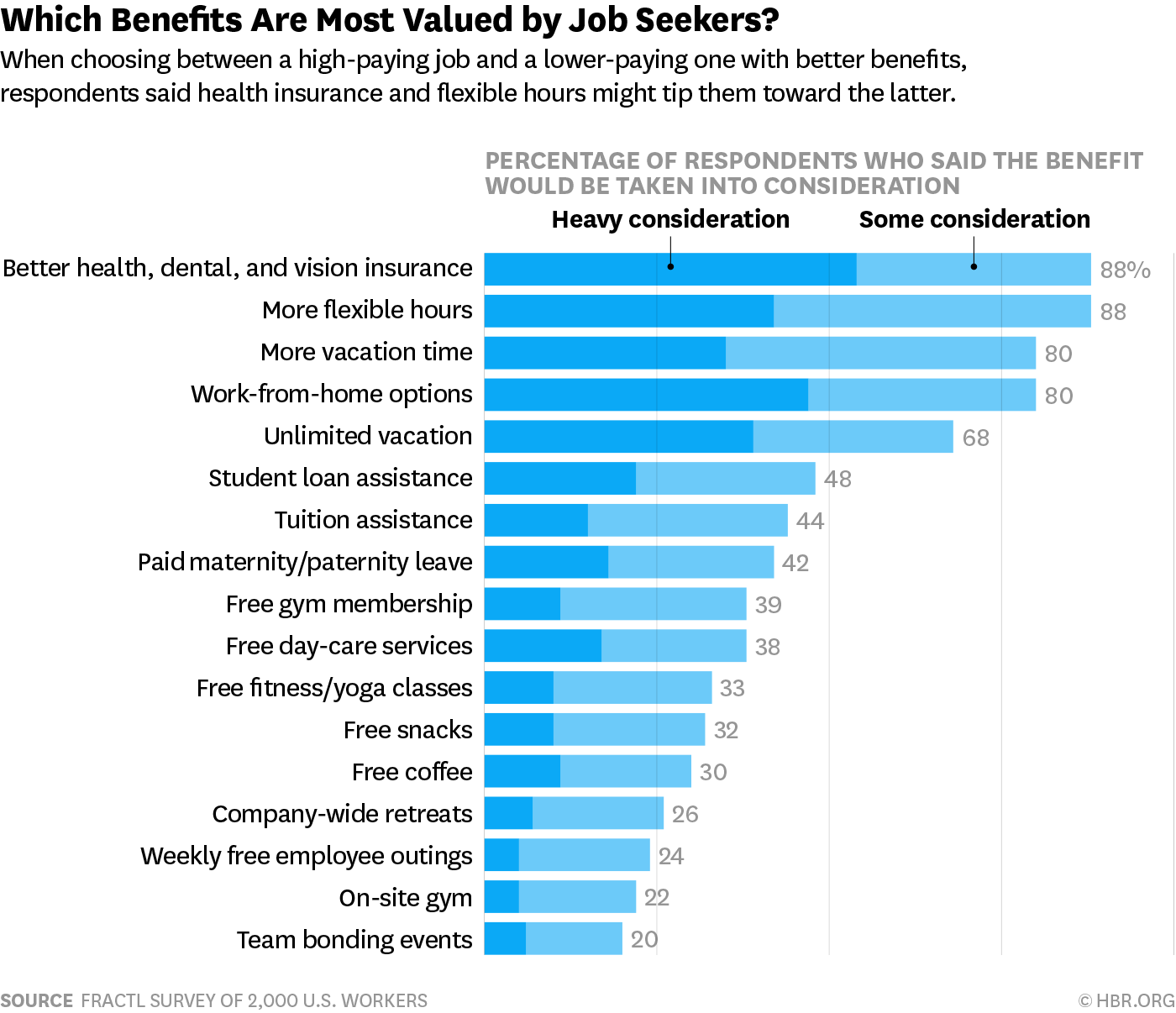

The saying “money talks or they’ll walk” is not always true. Today’s employees are frequently looking for non-traditional benefits and they’re willing to trade financial compensation for those benefits.

Benefits like flexible work hours, student loan assistance, paid leave, and fitness classes are the kind of benefits that level the playing field for employers that can’t afford to offer large salaries. They’re also the kind of benefits that attract and retain top talent.

What does this all mean?

It means you’ll want to be ready for clients to ask about voluntary benefits, and you’ll want to be ready to connect them to ancillary lines of coverage. A NYC commuter benefits program is a required benefit for some, but in areas where it’s not required, a commuter benefits program is nice perk for employees.

3. Employers will give more control to brokers who can help them save money by transitioning to self-funded plans

Between 2013 and 2015, the percentage of small employers self-insuring rose by 1.1% and the percentage of midsize employers rose by 4.8%.1 This trend will likely continue into 2018 and beyond.

Employers site several reasons for switching to self-funded plans. But, their primary objective is to control healthcare spending with a desirable plan.

With some employers saving over a $600,000 per year on a self-funded plan, more employers are expected to make the switch, and that spells opportunity for brokers.

Brokers looking to capitalize on employers’ desire to self-fund their healthcare plan, will want to market performance-based services. Managing self-funded plans will also be a lucrative service to offer.

4. More employers will need help connecting with their employees

Brokers are becoming the “employee whisperers” of the healthcare industry. For whatever reason, employers struggle to communicate and “sell” the benefits they offer to their employees. Obviously, this is a costly scenario for employers and that’s why they’re looking to brokers for help.

As a broker, you’ll have an unprecedented opportunity in the coming years to provide immense value to your clients by simply being the person that’s capable of connecting their employees to the benefits available to them.

Start with a Reliable Partner

Despite the chaos, the rapidly evolving healthcare landscape will provide brokers with a wealth of opportunity. While there are many ways to capitalize on these opportunities, you’ll want to have the right resources and support in your corner first. Learn more about how Clarity Benefit Solutions can help today.

Sources:

1. https://www.shrm.org/resourcesandtools/hr-topics/benefits/pages/self-insurance-aca.aspx