A commuter benefit program can provide employees with a 40% tax savings!1 So, it’s no surprise that these benefit plans are on the rise. In this post, we look at commuter benefit plans and trends as well as commuter benefits administration. We also explain how to setup a commuter benefit program.

What are Commuter Benefit Plans?

A commuter benefit plan is a solution to high commuting costs. A commuter benefit plan lets employees set aside a portion of their income, pre-taxes, to pay for public transit and parking, so long as those costs are part of their commute to work.

What’s Happening with Commuter Benefit Plans?

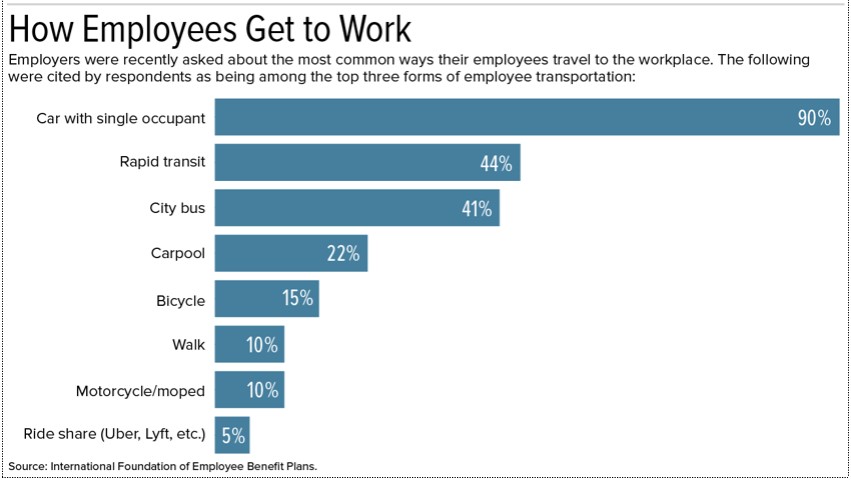

Last month, the International Foundation of Employee Benefit Plans published a survey detailing what’s happening with employee transportation and employee transportation benefits and incentives. Here are their five key takeaways:

1. 31% of employees participate in mass transportation incentive programs when such programs are offered by employers

2. Approximately 33% of polled employers offer incentives to those who use mass transit and carpooling; 33% also offer incentives to employees who walk or bike to work

3. 56% of polled employers who offer mass transportation incentives have a pre-tax benefit commuter benefit plan in place

4. Attracting and retaining top talent is the main reason why businesses offer transportation incentives

5. The second most common reason why companies offer commuter benefit plans is employee requests

When you consider how employees get to work and that commuter benefit plans are meant to support those paying for mass transit or parking, many companies are already meeting the needs of their employees:

When Considering Commuter Benefit Plans for Your Employees, Consider 2 Factors

If you’re ready to offer employees a commuter benefit plan, you need to consider two items.

1. Local Requirements

What are the city and state laws surrounding commuter benefits and transportation?

In NYC, commuter benefit laws have been in place since January 1, 2016. The law requires that non-profit and for-profit employers having 20+ full-time (non-union) employees in NYC offer workers the chance to use pre-tax dollars to buy qualified transportation benefits.

The NYC Commuter Benefits Law answers additional questions.

2. How Your Employees Get to Work

How do your employees get to work? Commuter benefit plans are aimed at those taking public transit and paying for parking while at work. If a large proportion of your office staff takes mass transit or pays for parking, it’s time to offer them a commuter benefit plan. In fact, you may be legally required to offer a commuter benefit plan.

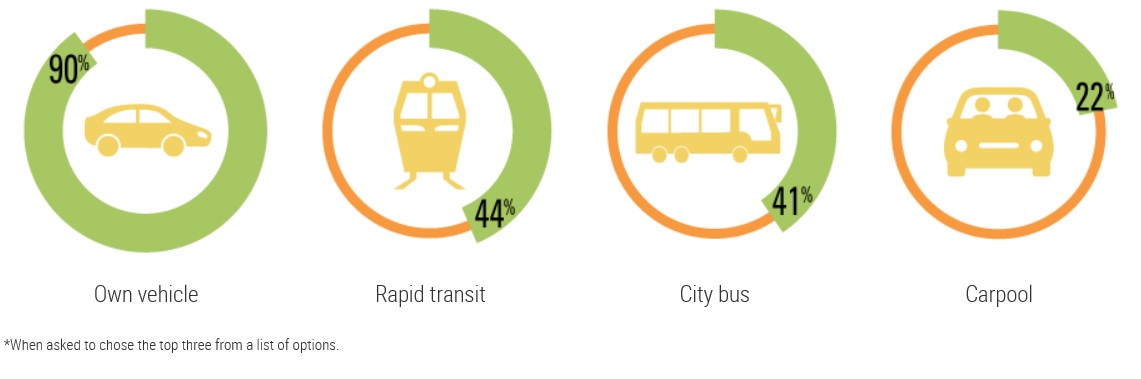

To see how your employees’ modes of transportation and parking might break down, consider the following information posted by the International Foundation of Employee Benefit Plans:

• Transportation Methods

According to their data, as many as 85% of employees use some form of public transit:

Of course, you’ll need to look at your company data or poll your employees to learn how your staff is getting to work. But, don’t be surprised if many of them take public transit.

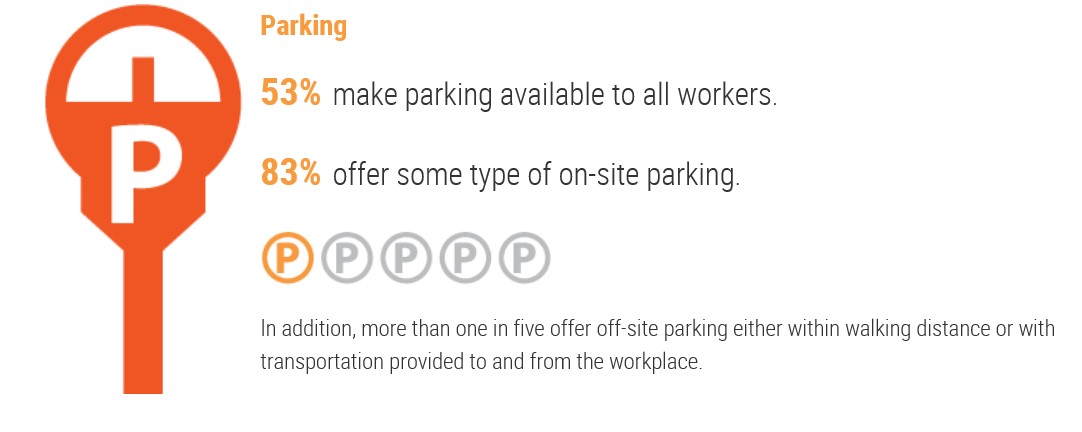

• Parking

More than 20% of employers ask employees to park off-site. In NYC, parking offsite usually comes with a price tag, and most employers will want support covering parking costs.

So, knowing what you know about how your employees get to work and NYC Commuter Benefits Law, how do you build the right commuter benefits plan?

Let’s break it down.

How to Build the Right Commuter Benefits Plan for Your Employees

Building the right commuter benefits plan is easy—just follow these simple steps:

1. Partner with a Reliable Commuter Benefits Plan Provider

Choose a partner you can depend on; one your trust. Though there are many providers to choose from, we pride ourselves in providing quality and dependability.

2. Make Sure Your Provider Offers the Right Benefits

We’re proud to offer those who take advantage of our commuter benefits plans several tremendous benefits. For example:

• Clarity SmartRide consumers save an average of 30% off their commute

• Companies save up to 7.65% on every dollar they contribute to a commuter benefits plan on behalf of participating employees

Plus, employees benefit from using:

• A Smart Debit Card- Employees get a Clarity Consumer Benefits Card which gives them access to all their Clarity accounts. They simply need to swipe at point of purchase. The card will be accepted anywhere that takes MasterCard.

• Online Enrollment- Employees don’t have to guess about pre-tax benefits because our paperless consumer benefit enrollment platform does the work for them.

• A Mobile App- Employees can manage their benefits from their smartphone. Specifically, they can enroll, check balances, process claims, report lost/stolen cards, and sign up for email and text alerts.

3. Choose a Commuter Benefits Plan That’s Easy for Employees to Use and Easy to Administer

Commuter benefit plans are pretty simple to set up and administer. Here’s how they work:

1. An employee makes a monthly contribution for transit and a separate contribution for parking (up to the IRS limit)

2. After updating your payroll provider, the funds are automatically deducted from your employee’s check, pre-tax

3. Employees can start, stop, and change their elections monthly

4. Unused funds carry over to the next month

5. A Clarity Smart Debit Card is mailed to the employee’s home and programed to work anywhere they pay for mass transit, parking, or ride share programs.

New Year, New You

Start attracting and retaining top talent this year with commuter benefits. It’s hard enough to compete for fantastic employees, don’t make it any harder. Get setup with a proper commuter benefits plan by learning more today at Clarity Benefit Solutions commuter benefits. We’re here to help with benefits solutions!

1. https://www.benefitresource.com/blog/growing-popularity-commuter-benefit-programs/