Millennials have been named the most at-risk generation when it comes to life insurance, meaning their lack of adequate life coverage leaves them unprepared for unexpected life events. New York Life’s 2018 Life Insurance survey uncovered that only 10% of employees have the life insurance they self-reportedly need. These needs include mortgages, retirements, and children’s educations.

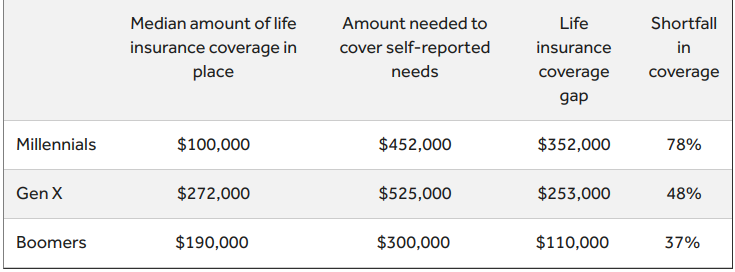

Here’s how they stack up against other generations, according to the survey:

Source: New York Life's Insurance Gap Survey, 2018.

Based on this data, it’s obvious that millennials are not enrolling in life insurance at the same rate as their predecessors. While the majority of the workforce now consists of millennials, this is a gap that employers should be addressing, as it could affect the overall well-being, productivity, and loyalty of employees.

Why aren’t millennials enrolling in life insurance policies?

In order to help their millennial employees change these grim statistics, employers should first understand why millennials aren’t taking out life insurance policies. While there is a stereotype surrounding millennials for choosing luxury items over future investments, that only tells part of the story.

Individuals under 30 make up the highest concentration of borrowers in the $1.3 trillion student loan debt crisis in the United States. They are making average payments of over $300 a month, most of which is going to interest and barely scratching the surface of the principle. At current rates, millennials will carry student loan debt for decades, rather than years. This impacts their ability to set aside money for long-term investments like life insurance.

What can employers do to help?

While employers can’t control the financial decisions of their employees, there are some things they can do to make sure employees get the coverage they need:

Provide affordable life insurance options. If your company is able to, consider setting up employer-funded life insurance. This makes the decision easy because cost is not a factor. If that is not something your organization is able to do, make sure the options are affordable enough to fit into millennials’ budgets. Give them the option to revise their plans as their financial situation changes so they can increase their coverage over time.

Address financial concerns. Millennials are not securing their future because of financial issues in the present. Addressing those could help put your employees in a better position for purchasing life insurance and saving for retirement. Consider offering a student loan repayment program, one of the hottest voluntary benefits on the market, to address the number one financial concern of millennials.

Offer other financial wellness tools. Assisting employees in other money management areas can help them create the space in their budgets required for life insurance and retirement planning. This includes things like bringing in experts for seminars and providing budgeting and investing tools.

Helping millennial employees get life insurance coverage and secure their financial future can increase employee satisfaction and productivity. Remember, employees rely on their employer to help them access important benefits like life insurance. Making sure they are properly educated about life insurance and have the tools for financial success will give them confidence in you as an employer and set them up for success.

Sources:

https://www.newyorklife.com/newsroom/2018/life-gap-survey-millenials-at-risk

https://www.forbes.com/sites/zackfriedman/2017/02/21/student-loan-debt-statistics-2017/#12e108065dab