Low unemployment rates are a good thing for the U.S. economy—more people are working and more money is circulating throughout the economy. The downside for employers, however, is the fierce competition means that they have to step up their recruiting tactics.

In the past, sign-on bonuses and promises of flexible working hours have been enough to attract top talent. But with millennials taking over the workforce rapidly, that is just not enough. In the war for top millennial talent, employers need to play smart and address the real needs and concerns of this demographic: student debt.

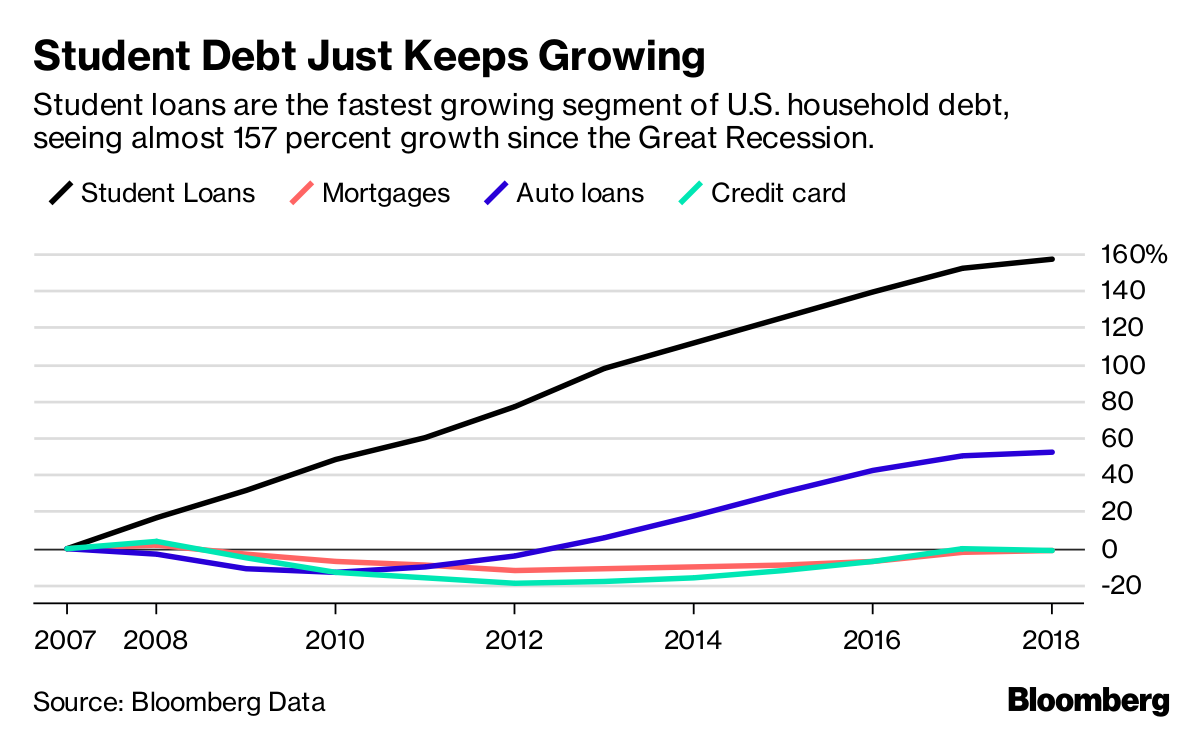

According to the Federal Reserve, people in the U.S. owe a collective $1.5 trillion in student loans, with about 65% of that belonging to people under 40. That number has skyrocket recently and shows know sign of slowing down anytime soon.

The burden of student loan debt is taking its toll on the millennial generation. They are putting off major financial decisions like purchasing a home or saving for retirement and carrying the stress of financial burden. In fact, nearly 65% of millennials have considered getting a second job solely to help pay off their loans. This places a huge mental and physical burden on these young adults who are trying to establish themselves in careers.

What employers can do to attract valuable millennial talent while addressing this concern is offer student loan repayment programs as part of the employee benefits package. Usually administered through a third party, these programs allow employers to make contributions to their employees’ principal amounts, so long as the employee maintains minimum payments on their own.

Some employers are hesitant to take on such an expensive benefit. But regardless of cost, these programs are becoming essential for attracting the right employees. Tech-focused start-ups, for example, absolutely need to attract tech-savvy millennials with specific, sought-after skills. If expense is a concern in your organization, there are still things you can do to attract talent with student loan forgiveness initiatives:

- Craft a program where you as an employer don’t contribute, but they help their employees direct part of their paychecks towards student loan payments.

- Determine a limit for your annual contribution to student loan programs.

- Incorporate student loan forgiveness into your diversity initiatives, as women and minorities carry the highest amount of student debt.

- Offer employees access to expert guidance about student loan repayment options.

Showing that you understand the millennial concern of student loan debt can help you attract—and retain—workers in this demographic. An American Student Assistance survey revealed these statistics:

- 86% of employees would commit to a company for 5 years if that company helped pay back student loans.

- 89% of employees would use long-term financial planning tools or advice if offered by the employer.

- 79% of employees would take advantage of free access to a student loan debt counselor.

By understanding this need and the solutions available, employers can set themselves apart from the competition by offering a truly attractive benefit.

Sources:

https://s3-us-east-2.amazonaws.com/staging.asa.org/wp-content/uploads/2018/08/14141823/asa_young_worker_and_student_debt_survey_report-1.pdf