Benefits are top of mind for many clients in January and February. If they haven’t reached out to you already, it would be wise to drop a line and see how they’re doing. Try starting a conversation about this year’s top voluntary benefits, why they’re worth having, and why they’re trending in the first place. We suggest using this post to organize your thoughts before calling or emailing your clients.

What’s Behind Top Voluntary Benefit Trends in 2018?

Two factors seem to be driving voluntary benefit trends so far, this year: a historically low unemployment rate and an increasingly diverse workplace. Let’s look at why.

A Low Unemployment Rate Drives Employers to Offer Voluntary Benefits

With fewer employees looking for work, employers need to offer extremely attractive benefit options to retain the talent they have and attract top talent from a shrinking pool of job seekers. As the chart below shows, the unemployment rate has decreased substantially over the last several years. The rate held steady in December 2017 at about 4% and just under 150,000 jobs have been added to the national labor market between now and then.1 If this trend continues, which it looks like it will, employers will need to entice workers to their company, and extra benefit options that go beyond typical health plan benefits will be just the ticket.

Unemployment Rates

Source: U.S. Bureau of Labor Statistics

An Increasingly Diverse Workplace Prompts Employers to Opt for Voluntary Benefits That Cater to a Variety of Workers

While there’s no doubt that diversity has increased in the workplace in many ways, the age range of employed persons in the U.S. is of considerable interest to brokers. With workers ranging from college-age to retirement-age, employers now have to offer benefit options that cater to the many different life stages that now exist in their companies.

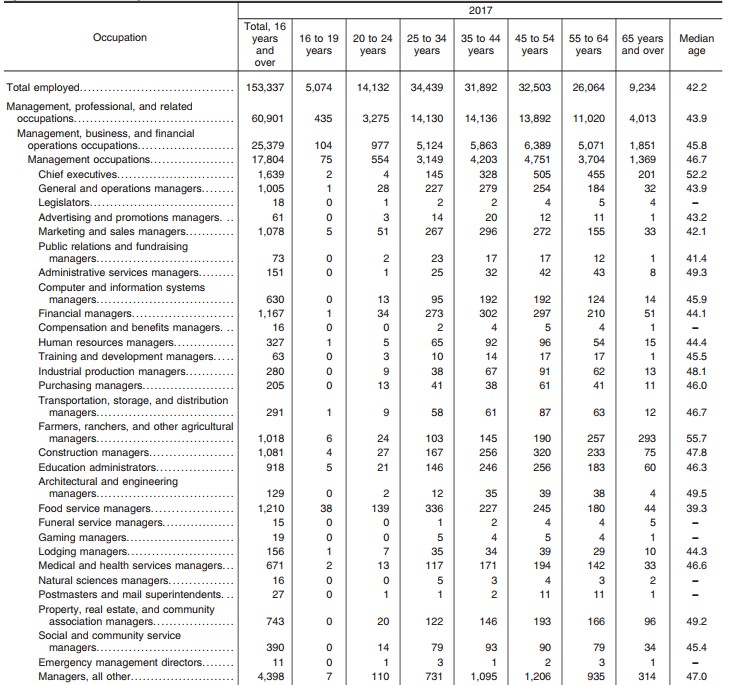

Employee Age Distribution in Select Occupations

Source: U.S. Bureau of Labor Statistics

The chart (above) is supplied by the U.S. Bureau of Labor Statistics. It captures just how diverse workplaces are in terms of age—and this chart only displays age distributions for a fraction of all occupations!

The widespread distribution of age in the workplace will continue in 2018 for most occupations, and likely, beyond. Voluntary benefit options can address specific life stage-related challenges that may not be adequately addressed by typical health plan options.

So, it’s a good idea to help your clients find additional, voluntary benefits that that meet the needs of their workforce—from their recent college grads to their near-retirement employees.

9 Top Voluntary Benefits for 2018

Knowing what’s driving voluntary benefit trends this year is essential when pitching to clients. Based on the abovementioned trends, we recommend connecting clients to these 9 options—they are the most popular, and likely, most useful for your clients this year.

1. Long-term care

Clients shouldering the burden of increased healthcare costs will find some relief when employees enroll in long-term care benefits.

Older employees who need to be particularly mindful about their life savings will appreciate this benefit because it prevents them from spending their savings, which they will live on during retirement, on chronic illnesses, disabilities, and other conditions. It also reduces the burden that would be felt by their family members if they need care. Younger employees thinking ahead to saving for retirement will also like this benefit.

2. Student loan assistance

Only 4% of employers offer student loan benefits.2 Companies looking to nab top talent from a shrinking pool of job seekers will gain a serious advantage by offering student loan assistance, especially when it comes to attracting recent college grads who are also cheaper employees.

This benefit will appeal to millennials, recent college grads, and those in their late twenties to mid-thirties who are still struggling with student debt and possibly putting off saving for retirement as a result. In fact, nearly a third of workers would prefer student loan repayment benefits over health benefits.3

3. Personal financial planning

One-third of employees struggle with finances to the point of distraction at work—meaning they’re in serious need of financial help and their productivity at the office is dropping because they’re preoccupied with how they will make ends meet.4

Your clients may want to consider providing financial assistance programs to maintain a high level of worker productivity.

Financial planning benefits appeal to all ages—younger employees saddled with student debt struggling to save for a house and family, middle-aged employees with families to support and high credit card debt, and older employees paying for their kids’ college tuition and saving for retirement.

Of course, a commuter benefits program could be an alternative to financial planning benefits, or an add-on. Transportation costs are expensive. Offsetting those costs with NYC commuter benefits will be a tremendous help for many workers.

4. Identity theft

Employees are actively seeking to protect their identity and finances. In fact, reports show six out of seven individuals act to prevent identify theft.5 Employers who provide workers with options to protect themselves from this threat will appeal to job seekers.

This benefit will attract workers of all ages. Though, intriguingly, females have fallen victim to identity theft more often than men.5 So, this benefit may appeal more strongly to women or those in charge of their household’s finances.

5. Supplemental healthcare options

Companies who can provide employees with ways to “bridge the gap” between what they’ve saved in a health savings account and what they owe for a medical expense will have a much easier time attracting and retaining talent. While the Ready for Life HSA is specifically meant to bridge this type of gap, supplemental health care options offer similar benefits.

This type of benefit will appeal to older employees, employees with children, and employees planning to start a family. Addressing many of the life stages likely to be present in a company’s workforce is a must and this benefit is an excellent way to do that.

6. Voluntary pet insurance

Americans spent nearly 16 billion dollars on medical care for their pets last year.6 Imagine how much of a relief it would be for employees to receive assistance caring for their pet. Just like people toss medical or dental insurance into the pot, employees with pets could also toss pet insurance into the pot each year and rest assured knowing they can take care of their furry family member when something happens.

7. Pre-paid legal

Employers who cover legal costs associated with drafting a will, adopting a child, purchasing a home, and more will receive favorable impressions from job seekers. In an environment where company reviews and interview experiences are shared online, this benefit offers a rare perk that’s likely to be talked about and remembered as it applies to any employee, regardless of age.

8. Discount purchase programs for fitness wearables

More than 50% of employers offering wellness programs see a decrease in absenteeism. Help employees afford the cost of fitness trackers, which they can wear during a workplace wellness challenge, and reap the benefits. Not only will employees be healthier, the cost of providing insurance will decrease, and worker productivity will increase.7

9. Educational training and access

This benefit goes hand-in-hand with student loan assistance. However, this benefit extends beyond traditional academic training, so it may appeal to those who would pursue certificates and advanced non-degree bearing training in their field. Employees serious about advancing their careers will be attracted to companies that offer this benefit.

The Time is Now

Google Trends shows queries related to voluntary benefits are up by 70%--and there’s a reason for it. January and February are popular months for evaluating health care plans and benefits. So, don’t delay. Get your clients on the phone and start talking about how they can benefit from voluntary benefits.

1. http://www.us.jll.com/united-states/en-us/research/employment-rate-data-trends

2. https://www.usnews.com/education/blogs/student-loan-ranger/articles/2017-03-29/young-workers-turn-to-employers-for-student-loan-debt-solutions

3. https://www.shrm.org/resourcesandtools/hr-topics/benefits/pages/student-loan-assistance-benefit.aspx

4. https://www.pwc.com/us/efwsurvey

5. https://www.bjs.gov/content/pub/pdf/vit14_sum.pdf

6. http://www.americanpetproducts.org/press_industrytrends.asp

7. http://www.benefitspro.com/2017/06/08/wellness-programs-on-the-rise-as-employers-conside?page=2&slreturn=1516666773