Financial wellness programs and financial benefits were a big trend in 2017 and they’ll continue to be one of the hottest trends in 2018. So, it’s time to think about what you could be doing to address the needs of your clients’ employees. In this post we look at why brokers need to be concerned about employee financial well-being and we suggest several effective strategies for approaching clients about employee financial well-being and more.

Why Brokers Should be Concerned about Employee Financial-Well Being

The financial well-being of employees affects your clients and anything that affects your clients affects you. So, it’s wise to be concerned about your clients’ employees’ financial well-being, especially considering employee financial problems are taking a toll on their productivity and health.

In fact, the impact that financial problems have on employees has received a great deal of attention—from research to conversations at conferences and beyond—the rising lack of financial wellness has employers, HR officers and brokers concerned, and it’s no surprise as to why.

Just look at what we know about the cost of poor financial fitness in the workplace:

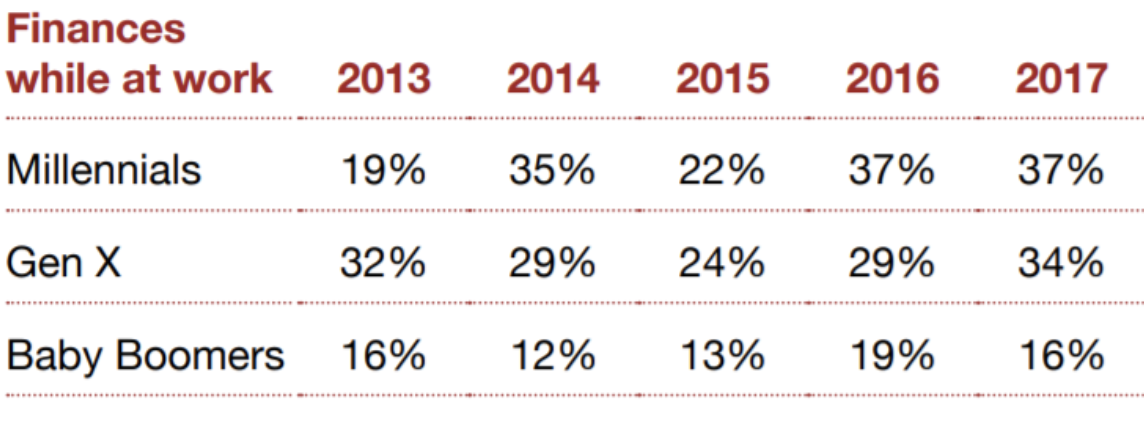

- 30% of employees admit that their personal finances have distracted them at work and 46% of these individuals spend three plus hours at work per week thinking about or dealing with their personal finances. The chart below illustrates the percent of employees in each generation who spend time at work being distracted by personal financial problems.

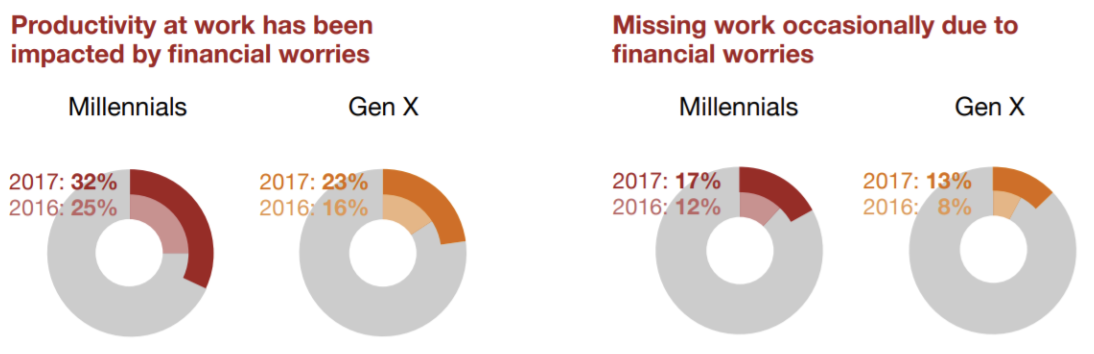

- 22% of employees admit that personal financial concerns have impacted their productivity at work, and as the charts below illustrate, the number of Millennials and Gen X employees affected by financial problems has increased, both in terms of productivity and absenteeism.

Impact of Financial Problems on Productivity and Absenteeism

The impact of employee financial well-being on workplace productivity isn’t the only concerning trend. Financial problems have far-reaching consequences. They affect an employee’s health mentally, emotionally, spiritually, and socially.

Case in point:

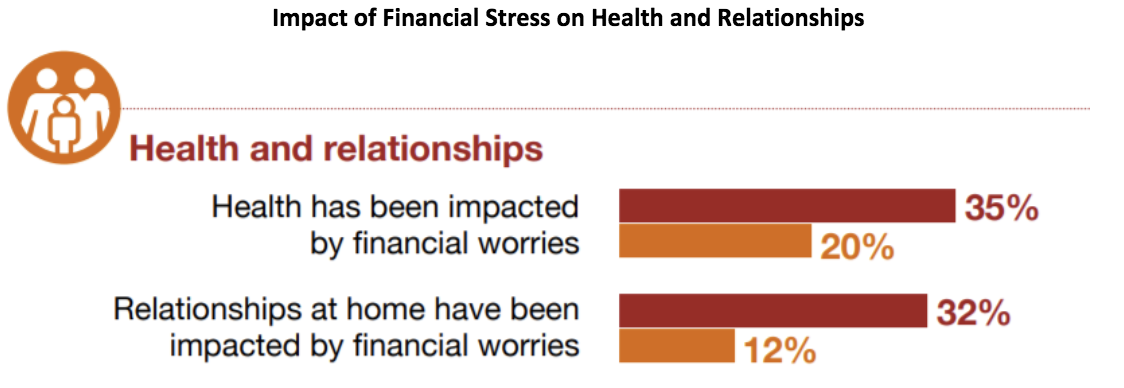

- 35% of employees stressed about their finances (represented by the red bars, below) have had their health affected by financial stress, and 32% report that financial worries impacted their relationships at home. (Orange bars represent those not stressed by their financial situation).

The statistics reported in the 2016 Employee Financial Wellness Survey1 are even more alarming:

- 52% of workers l are stressed about their finances—and the younger the worker, the more likely it is that they’re worried (64% of Millennials report being stressed about finances)

- 46% of workers spend three hours or more between Monday and Friday dealing with or thinking about financial issues

- 45% of workers report that their finance-related stress increased over the last 12 months

The data makes it obvious—there’s no denying the fact that financial problems are wreaking havoc on workplace productivity and employee health.

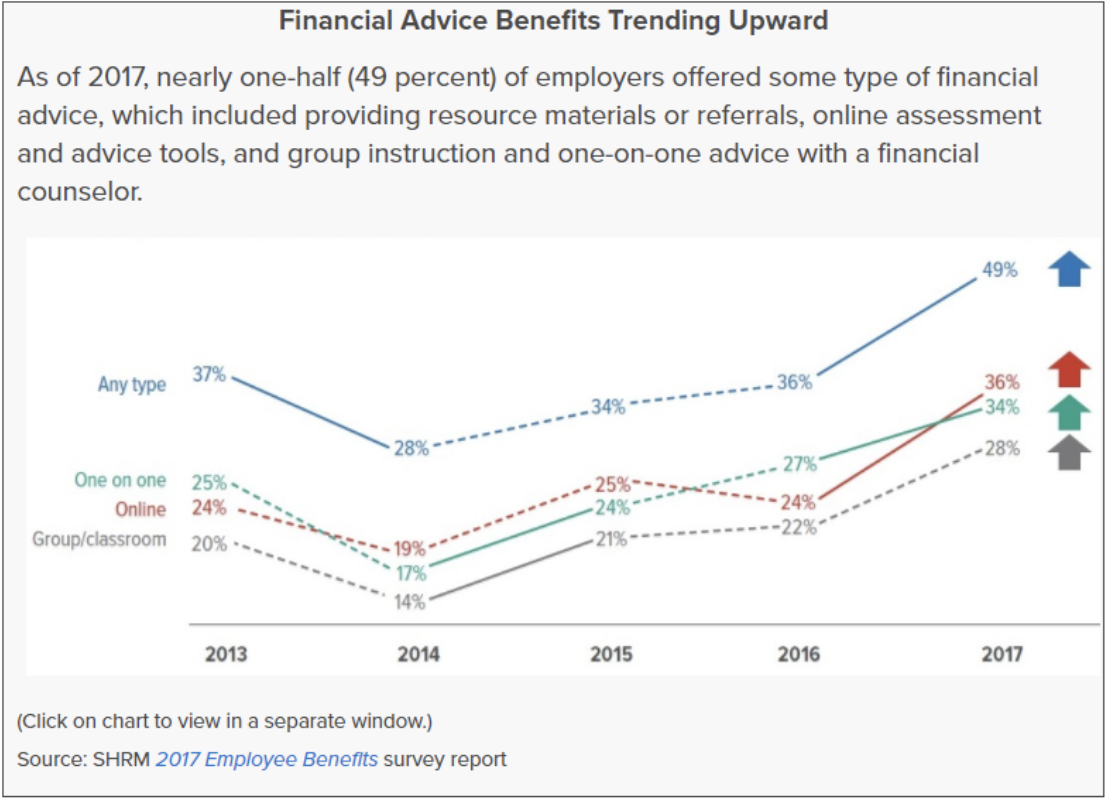

In fact, the impact that financial problems have on employees and company productivity have human resource managers responsible for employee benefits concerned. So much so that financial benefits are one of the hottest trends right now.

So, what do these financial wellness trends and statistics mean for you as a broker, and why should you care?

Well, the data tells us that your clients need or will need to offer employees some sort of financial assistance, and that’s an opportunity for you.

Now is the time to start talking to your clients and their employees about financial wellness programs and voluntary employee benefits that alleviate or minimize financial burdens, and here’s how you can get started.

4 Ways to Approach the Topic of Financial Well-Being and Employee Benefits

There are different ways to approach clients about their employees’ financial well-being and employee benefits. How you approach them depends on what their goals are. If they want to implement a financial wellness program, you’ll want to approach them in the ways illustrated below. However, if they’re simply interested in employee benefits that can alleviate and/or reduce employee financial problems, then you can discuss potential options and help them get setup with the option that’s best for them.

1. Help clients identify and define their goals for a financial wellness program

Employee financial problems can be all over the map—from trouble saving for retirement to overwhelming student debt and more. So, it’s wise to assess what needs employees have and how a financial wellness program can address those needs. As a broker, you can initiate this conversation and become an invaluable resource. When approaching clients to discuss their goals, here are a few goals you could suggest:

- Better 401(k) education

- Reducing withdrawals from retirement funds

- Improve basic budgeting skills

- Increase wealth building knowledge

When suggesting goals that will serve as the foundation of a financial wellness program, it’s important to let your clients know that education-based interventions need to be backed up with behavioral change strategies, because education alone will not have a significant impact. The best results are achieved when education is supported by actionable steps.

2. Connect clients with resources for their financial wellness program

After clients have decided what they want to focus on in their financial wellness program, you can cement your position as a likeable expert by connecting them with several resources that make program execution easier. Finding a reliable partner who can supply such materials will make your life much simpler.

3. Help clients track and report on the success of their financial wellness program

After the program is up and running, don’t disappear. Instead, stay in the loop and help clients track and report the results of the wellness campaign. If things go well and the campaign generates positive results, you’ll be a star. Not to mention, by being involved in the tracking process, you can identify potential problem areas that could derail the success of the program. By troubleshooting early, you can help you clients maintain an effective program, reinforcing your value.

4. Review what your clients are currently offering and suggest additional employee benefits

Ask your clients about what they are currently doing in the way of employee benefits related to finances and the like. This discussion can serve as a springboard to introducing new or better benefits.

In some cases, clients may not be taking advantage of all the benefits that are available to them. If that’s the case, you can reassure them that they already have access to an array of helpful resources and you can help them take advantage of what they already have available.

Voluntary benefits that you may want to mention include but are not limited to:

- Student loan assistance programs

- Funding for continuing education

- Gym memberships

- Accident insurance

The benefits you suggest don’t need to be directly related to finances. You can offer ways to offset how much an employee spends each month. Financial support for gym memberships, for example, is a great option. It keeps employees healthy and reduces their monthly expenditures.

Get Support in Your Pursuit to Help Clients and Employees with Financial Well-Being

There are several employee benefit solutions and benefit administration solutions available to you. Assisting clients and their employees with financial wellness starts by acquiring a reliable partner. Clarity has established partnerships with several businesses, many of which can help you help your clients implement financial well-being programs and benefits. Learn more today at Clarity Benefit Solutions.

Sources:

1. https://www.shrm.org/resourcesandtools/hr-topics/benefits/pages/financial-wellness-trend.aspx