The Department of Labor can conduct an ERISA audit on your clients at any time. Are they prepared? This is especially difficult for smaller companies that may not have the resources to dedicate HR staff to ERISA compliance.

As a broker, you can simplify ERISA compliance for your clients in a few steps:

Educate them on what is subject to ERISA

ERISA applies to “most private sector employee benefit plans,” including retirement plans and welfare plans. Make sure your clients know which parts of their plans are subject to ERISA so they can take the proper compliance steps. For example, most employers would probably know that their dental and vision plans are subject to ERISA, but maybe not their health flexible spending accounts. There are also a lot of special and contingent circumstances regarding plans like incentivized wellness plans, employee assistance programs, and cafeteria plans that employers may not be sure of.

Your clients will then have to count on you to help them clear up the confusion. Cross-reference your clients’ current offerings with what is subject to ERISA to create a list of their offerings that apply. That way, they have a clear, simple starting point for audit preparedness.

Help them provide necessary information to employees and dependents

Employees will undoubtedly have questions about their plans. Help employers get a head of those questions by providing them with comprehensive summary plan to give to employees and dependents.

These documents are not only helpful, they are mandatory; failure to provide one within 30 days of an ERISA audit can result in a penalty of $110 per day.

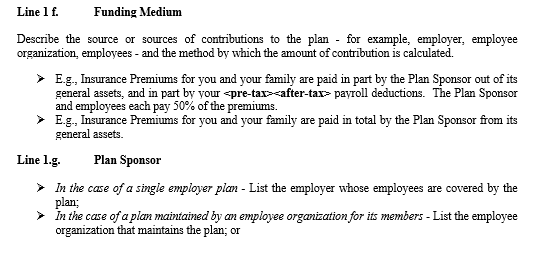

Below is an example of the ERISA wrap document requirements and plan information in a summary document:

This ERISA wrap document is not only helpful for compliance, but also informs employees and their dependents about key plan information.

Create necessary documentation

This step is where you as a broker can really simplify the process for clients. Most smaller clients lack the time and resources to create custom documents and summary plan documents for each benefit they offer. You can offer your clients a ERISA wrap document, which includes the plan documents, the summary plan documents, ERISA updates, special notices and more. As SHRM explains, “the wrap document fills the gaps left by insurance carriers and third-party administrators” and “consolidate[s] welfare benefit plans into a single plan.”

Providing this for your clients reduces administrative burden and reduces the amount of required reports. But be sure to do this in a way that is simple for you as a broker as well. Clarity Benefit Solutions now provides software for automating the building of ERISA wrap documents. This makes it easy for you to deliver peace of mind to your client – they never have to wonder if they will be left unprepared for an ERISA audit.

Sources:

https://webapps.dol.gov/elaws/elg/erisa.htm

2https://www.dol.gov/general/topic/health-plans/erisahttps://www.priorityhealth.com/employer/~/media/69D3854CD4CC40519F59D40684BE0308.ashx

https://www.shrm.org/hr-today/news/hr-magazine/pages/0113-wrap-documents.aspx