Brokers that want to gain a competitive advantage should begin speaking to clients about the benefits of adviser-guided enrollment. Leverage these three benefits as a starting point when initiating conversations with clients about adviser-guided enrollment and how it can reduce internal workloads.

Three Ways employee Benefits advisers Ease Work Loads

1. Benefit counselor guided enrollment eliminates the challenges associated with discussing an employee’s health

According to the 2016 Edelman Trust Barometer survey, about one third of employees don’t trust their employers. When managers and rank-and-file employees were surveyed, the numbers were even higher—approximately half of managers and 48% of rank-and-file employees have misgivings about their company.1 These statistics are problematic for workplaces looking to save money on healthcare expenses.

Employees that are hesitant to discuss their health, or their family’s health, with their employers are more likely to make misguided healthcare decisions—decisions that could cost both employees and employers more money at the end of the day.

Adviser-guided enrollment can address these challenges. Benefit counselors can have private, confidential conversations with employees about their health and advise them based on their unique needs. Benefit counselors working with brokers and their clients can empower employees to make decisions that meet their healthcare needs at a cost they can afford. This is very important, because not only do employees cite health coverage as the leading driver of job satisfaction, but 76% of younger employees believe customized benefits will increase their company loyalty.2

Providing the resources and privacy employees need to make important decisions about their health pays—not only will employees be happier, but benefit managers will have more time to focus on other tasks and HR can devote their time to executing their company’s larger HR strategy.

2. Adviser-guided enrollment reduces the workload typically shouldered by HR or the company benefit manager

Though C-level executives meet to decide on a company’s medical plans and offerings, giving a great deal of thought to their bottom line, it’s HR that’s ultimately responsible for implementing all that’s discussed and selected.

According to research conducted by leading research institute, ADP, 50% of companies don’t believe their HR department can keep up with healthcare-related regulatory requirements.3 The changing healthcare landscape has put an immense amount of additional work on HR’s docket.

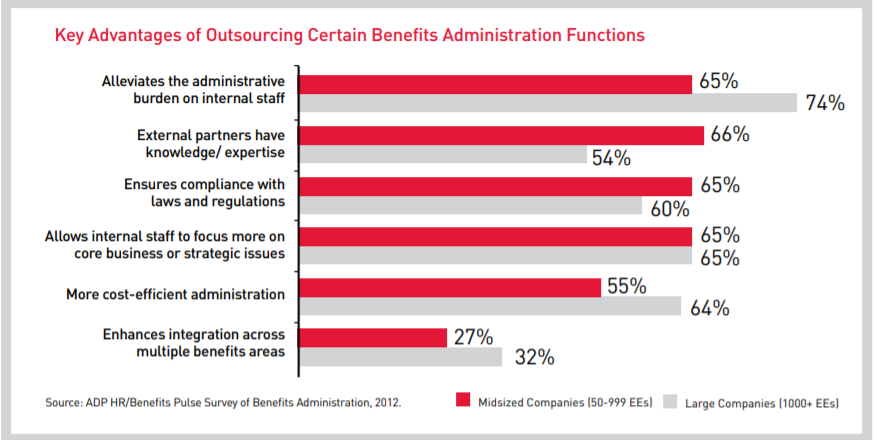

In fact, approximately two-thirds of mid-sized companies and 74% of large companies believe outsourcing administrative tasks would lift the burden faced by HR.3

Adviser-guided enrollment can substantially reduce the amount of work HR is tasked with by assisting because advisers can assist with updating employee contact information, confirming beneficiary designations, reviewing company policies with employees, outlining COBRA administration services, and more.

When an employee benefits adviser takes care of compliance filings and other administrative tasks, HR regains the time they need to focus on attracting and retaining top talent. And, with a benefits adviser to assist with information dissemination, education, enrollment, and compliance, HR can confidently advertise their first-rate health and wellness benefits—something that more than 50% of employees believe is important for company loyalty and retention.2

Not to mention, using a third-party to handle compliance increases objectivity. It also adds an extra layer of protection and security in the event of an audit.

3. Benefit counselor teams assist non-English speaking employees with healthcare decisions

A language barrier is a difficult hurdle to overcome if you only speak English, and if your job entails helping non-English speaking employees make healthcare decisions, open enrollment periods can be downright frightening.

Fortunately, there’s a solution. Benefit counselor teams assist brokers and their clients with non-English speaking employees. Remote and in-person meetings can be orchestrated to help non-English speaking employees with a variety of tasks.

In fact, benefit counselors can conduct the entire enrollment process in-person or remotely through a benefits administration platform in several different languages.

Outsourcing enrollment and other healthcare-related tasks to those who can take care of it efficiently saves time and money and reduces the amount of work HR must complete.

Want Less Work and Better Results? Partner with a Reliable Benefits Administrator

Improve efficiency, reduce workloads, generate better outcomes, save money, and increase employee satisfaction with adviser-guided enrollment. Offering the support your clients need will significantly strengthen your position as a broker in a rapidly changing benefits landscape. Despite the infusion of all sorts of benefits technology, the value of human support and guidance is not going to be displaced. In fact, adviser-guided enrollment and support is likely to become more important than ever. Learn more about adviser-guided enrollment options at Clarity Benefit Solutions today.

Sources:

1. https://www.shrm.org/hr-today/news/hr-magazine/0616/pages/0616-trust-in-leaders.aspx

2. https://blog.accessperks.com/employee-benefits-perks-statistics

3. https://www.adp.com/~/media/White%20Papers/ReportOutsourcing%20%20the%20Future%20of%20HRfinal.ashx

4. https://www.webmd.com/health-insurance/news/20060719/language-barrier-affecting-health-care#1