Hopefully you’re not experiencing a drop in sales, but if you are, there’s likely a reason for it. What it means to be a broker is changing. Being a broker isn’t just about connecting clients to products, carriers, and services like COBRA administration services, it’s about helping them understand the role of benefits in their organization, offering advice, and developing customized solutions to their challenges. So, if you’re ready to up your selling strategy in 2018, it’s time to transform how you do business. In this post, we look at what that means and how to do it.

Call Yourself a Consultant and Act Like One

Though those that have been in the business for decades may still use the term “broker,” it’s time to redefine yourself as a consultant and approach clients as a consultant, not as a traditional broker.

There’s a single powerful reason for this shift: the benefits landscape has changed and so have client needs. Employers want someone who can help them make sense of their business in terms of healthcare plans and benefits and benefit administration. They can gather information about plans, products, and pricing redistribution themselves.

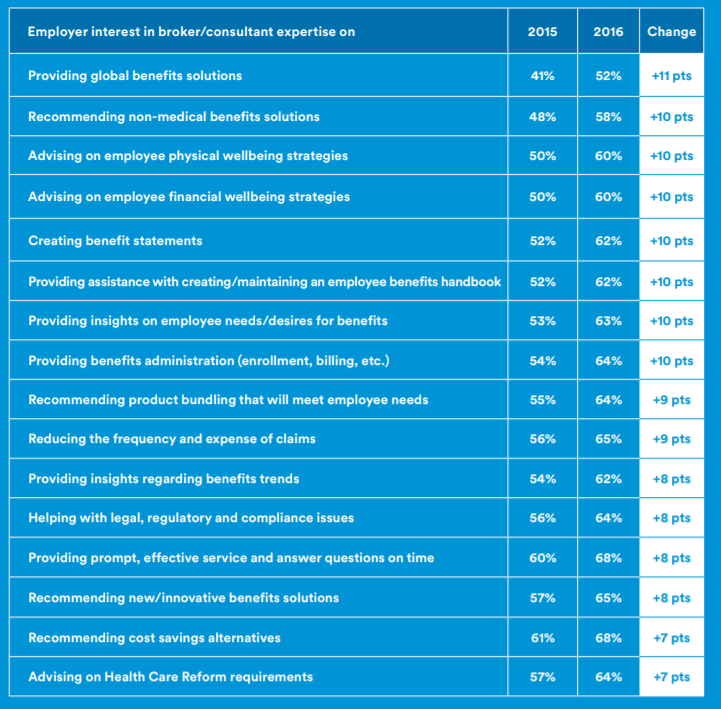

Case in point? Look at what research reveals about what employers really need from their broker/consultant:

So, if you want to continue to be in business 1, 2, 5, or even 10 years from now, it’s time to shift how you approach clients and how you sell your services. It’s time to redefine yourself as a consultant.

To assist you, we look at the differences that exist between a being broker, in the traditional sense, and a being a consultant, and we outline a few tips and strategies that you can use to up your selling game this year.

What it Means to be A Consultant

The traditional image of a broker has roots in what being a broker was like 20 years ago—a broker made 200 calls, got 20 meetings, and signed 4 new clients, and they acquired these clients by being experts in the healthcare products they sold, the carriers they represented, and the ways that employers could redistribute how they finance healthcare plans.

But, this way of doing business is being quickly replaced by a consultant-style client relationship wherein the broker has become an expert in customizing plans and programs based on their ability to understand their clients’ business, culture, employee needs, and more.

Top brokers are moving away from the old model of business toward the consultant model to offer clients what they want and need—and here’s what the difference looks like:

• A broker transacts. A consultant brings clarity to complex problems.

• A broker focuses on selling. A consultant focuses on solving problems objectively and offering advice.

• A broker’s deliverable may be a product or plan. A consultant’s deliverable expertise operationalized in the creation of a comprehensive program composed of customized solutions that meet unique needs.

• A broker reaches out when it’s time to renew a plan with information about rates and carriers. They might meet their client for an hour or two and hand them several documents. A consultant does that and more; specifically, a consultant encourages clients to contact them anytime they have questions, takes the time to explain complex documents, negotiates new rates with carriers, proactively shops the marketplace for their clients, and helps their clients demonstrate the value of the benefits they offer to employees.

So, if you’re ready to redefine how you sell your services, marketing yourself as a consultant, not a broker, we have a few tips to help you get started.

Ways to Make the Switch: 4 Tips to Up Your Selling Game in 2018

1. Change How You Market Your Expertise

Stop marketing your expertise in products, carriers, and health insurance financing, and start marketing yourself as an expert who can decipher how a business operates. Research shows that 63% of employers want help making sense of employee desires and needs and upwards of 60% of employers need help addressing healthcare and benefits in the context of business operations, regulations, and more.1 Show clients that you can help them make sense of the roles that benefits and human resources play in a company’s operations, engagement, and management of employees.

2. Transform Your Client Rolodex

Instead of continually getting in touch with the same people (i.e. clients that purchased healthcare plans from you in the past), focus on making new connections that hold different positions or offer a different type of value. For example, considering the popularity of workplace wellness programs, it may make sense to make new connections in the field of corporate wellness. When a client has an interest in starting such a program, you have the connections necessary to provide expert guidance on a range of wellness issues.

3. Advertise That You Take a Holistic Approach to Solving Client Challenges

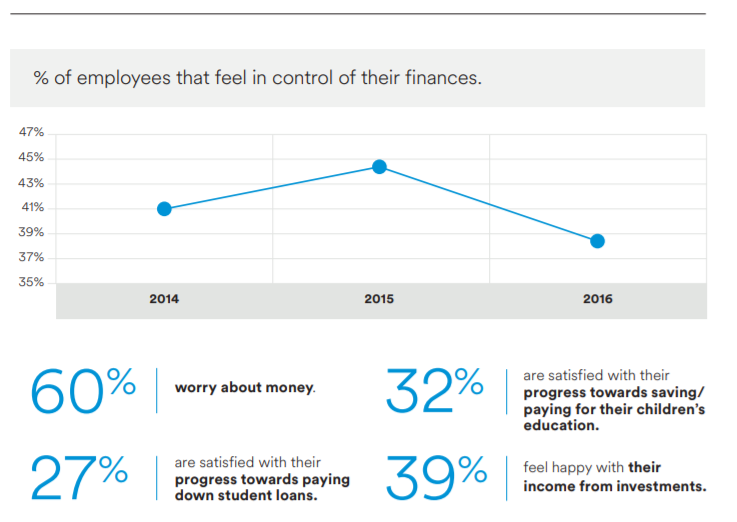

Employees are facing tremendous pressure from all directions. Just look at the results of a recent survey on employee concerns:

Workplaces that want to attract and retain top talent will need to opt for benefit solutions that consider the employee as a complete person with wellness goals, family responsibilities, and financial pressures, and they’ll want to prioritize helping employees achieve work-life balance.

As a benefits consultant, you have an opportunity to problem solve for your clients, helping them to create holistic solutions that address employee needs and desires completely. You can use your expertise to understand and provide insights into what employees want, and guide clients toward brighter futures.

4. Supercharge How You Approach, Win, and Maintain Client Relationships

Don’t just get in touch with clients 3 months before it’s time for them to renew their plans. Stay in touch all year long with e-newsletters, in-person phone calls and lunches, and more. Provide advice and proactively present new solutions to clients. Keep them updated about changes that affect them before they reach out and ask you about them. Attend new conferences and expand your network.

Shifting from Broker to Consultant Starts with a Reliable Partner

Before changing how you market yourself, transforming your rolodex, developing consultant packages, and supercharging how you win and keep clients, make sure you have the right tools and connections in your pocket. Though you’ll be selling expertise as opposed to products, you’ll still need to be connected to top notch products, carriers, and more. Clarity Benefit Solutions is committed to helping brokers grow and succeed. Contact them today to learn more!

Sources:

1. https://benefittrends.metlife.com/media/1382/2017-ebts-report_0320_exp0518_v2.pdf