In 2017, one of the most prominent workplace trends was the focus on employee financial wellness training and tools. Whether you realize it or not, you may have employees who are constantly worried about their finances—according to a recent report from the Personal Finance Employee Education Foundation, “approximately one in four workers suffer from serious financial distress.” Helping them improve their financial wellness is an effective way to help alleviate stress, and drive engagement and long-term retention.

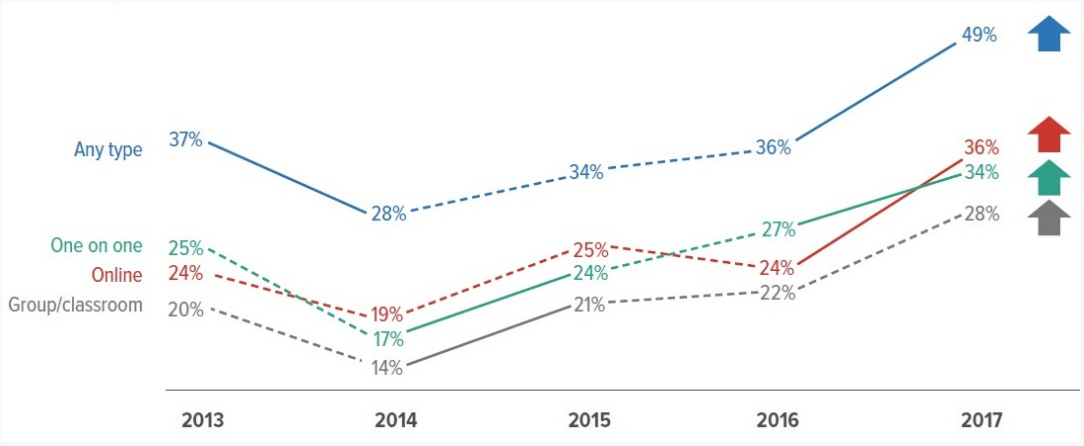

According to SHRM, “As of 2017, nearly one-half (49%) of employers offered some type of financial advice, including providing resource materials or referrals, online assessment and advice tools, and group instruction and one-on-one advice with a financial counselor.”

Source: SHRM 2017 Employee Benefits survey report

It’s a growing trend, and it’s easy to see why. Here are some guidelines for improving your employees’ financial literacy and how financial wellness can benefit them, as well as your company in general:

Ways to Improve and Enhance Employee Financial Wellness and Literacy Skills

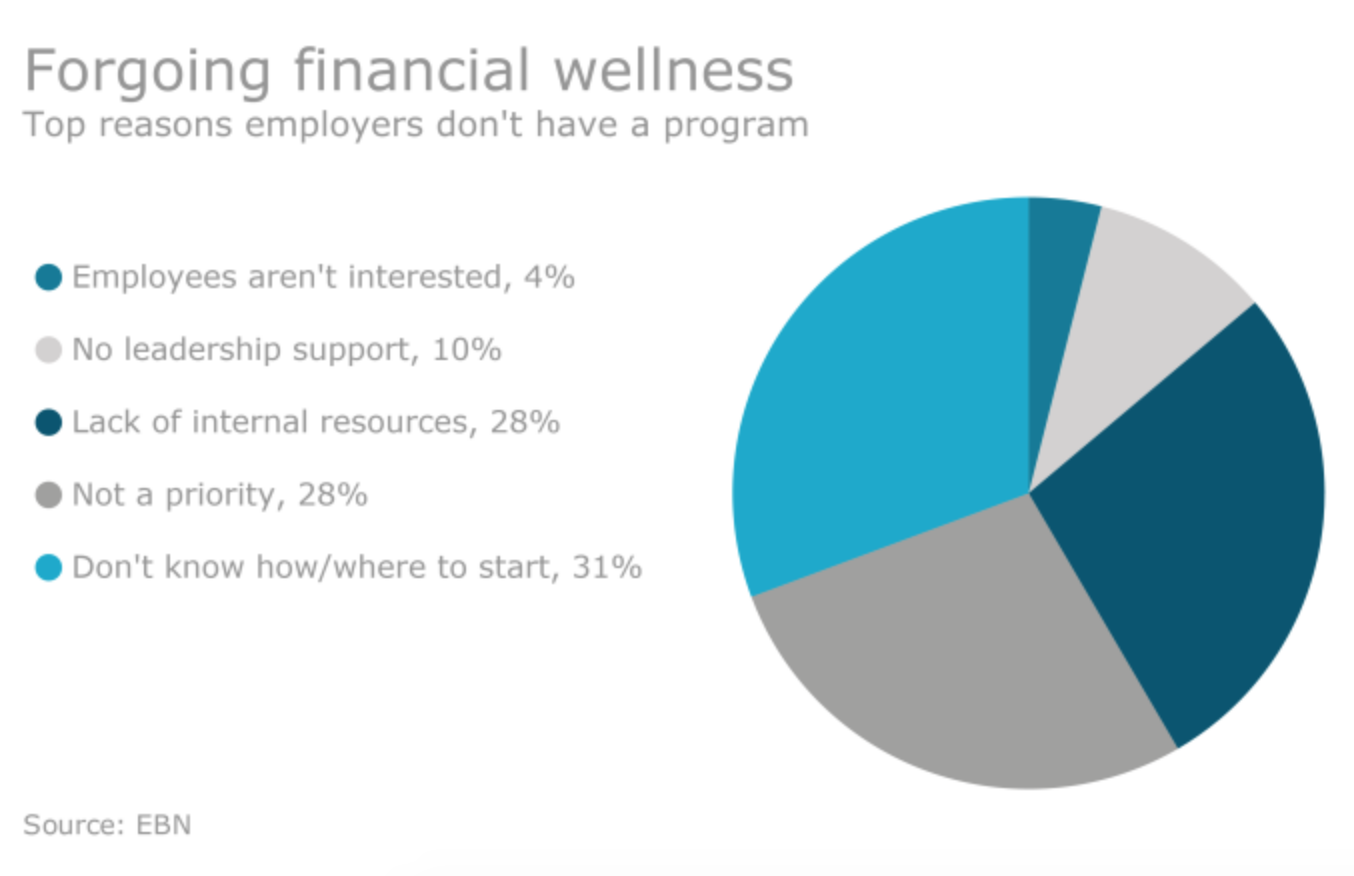

There are a variety of reasons why employers may not currently offer a financial wellness program, so it’s important to know where to start when it comes to enhancing financial literacy for employees.

1. Initial financial assessment

Help your employees conduct an initial assessment to uncover the reasons behind their financial stresses. This step will get them engaged and interested in making any necessary changes.

This is also a good time to help your employees define their financial goals and give them a direction to focus their efforts moving forward.

2. Free Financial Resources

There's an abundance of resources about financial knowledge, but it’s imperative to root out the unnecessary ones and direct your employees towards the most valuable tools and resources. When making your recommendations, consider how different employees absorb information and react to different types of resources. Also, consider every employee’s needs and direct them toward the materials that will be most beneficial for their specific situation.

3. Monthly Budgeting

Direct your employees to tools and calculators that will help them create budgets and track their long-term spending. Trackers will help keep them accountable, and accountability is key.

4. Online Training Courses

Give your employees the opportunity to learn more about fundamental financial principles through an informative and streamlined online financial education training course. Most people have never had any formal education about personal finance, so this could potentially dramatically improve your employees’ knowledge and comfort regarding their finances.

5. Individual Coaching

Lastly, employers can provide access to a financial coach so employees can receive more personal responses to their inquiries. A coach can also help drive more employees to take immediate action.

The Benefits of Improving Employee Financial Literacy and Gaining Better Financial Wellness

Financially healthy people make for more engaged, productive, and reliable employees. That is why Clarity recently doubled down on our financial wellness investment, adding a student loan assistant program to our employees’ benefits. Providing a program to educate and assist your employees will help draw in new talent as well as increase long-term loyalty from valuable current employees. The process itself will also increase the connection between you and your employees.

Carla Dearing, CEO of SUM180, an online financial wellness service, explains that while many employers may be reluctant about involving themselves in their employees’ personal finances, it is generally worth the effort: “Financial health is a major component of employee wellness. If employers say they're concerned about their employees' wellness, they can't ignore their role in helping employees improve their financial health.” It’s a somewhat simple, yet important, way to show that you care about your employees and their families. Regardless of your employees’ specific financial situations, financial literacy education will help optimize their performance across the board.

It’s also important to note that financial literacy can supplement other employee benefits many companies offer, like health insurance and 401(k) plan matching. Providing an education program can help increase employees’ participation in your other benefit offerings.

Busy schedules, stagnant wages, and a culture of consumerism all impact employees’ desire and ability to improve their financial wellness. As their employer, you can help disrupt this pattern and show employee appreciation by providing a well-designed program and, in turn, improving their satisfaction and productivity at the office and in their personal lives as well. For more information about improving your employees’ lives through benefit offerings, visit our employers’ page.

Sources:

1. https://www.benefitspro.com/2018/04/19/5-ways-employers-can-help-improve-employees-financ/

2. https://www.employeebenefitadviser.com/opinion/is-it-time-to-offer-financial-education-as-a-benefit