Are you wondering how to save money as an employee? More and more employees are struggling to save and balance their checkbook (or debit account). But, there’s no escaping the truth: saving is important. In this post, we look at the dire savings situation of employees and we show you how you can help your employees become better savers.

The Scary Truth about Employees and Their Saving Behavior

The Retirement Crisis and It’s Causes

America is facing a retirement crisis. According to the Boston College Center for Retirement Research, most Americans do not have enough savings to support them through retirement.1 Moreover, about 28% of Americans have no retirement savings or pension, and 52% of households with individuals nearing retirement age have only enough saved to generate a monthly income of $405.1 Even more alarming—social security provides most of the retirement income for those 65 years or older, though social security was meant to be a replacement for a much smaller percentage of the employee’s pre-retirement income.1

The retirement crisis has many causes. The most notable being2:

- Real wages, those adjusted for inflation, haven’t risen in about 40 years and in some cases, wages have decreased

- Individuals are simply not saving enough

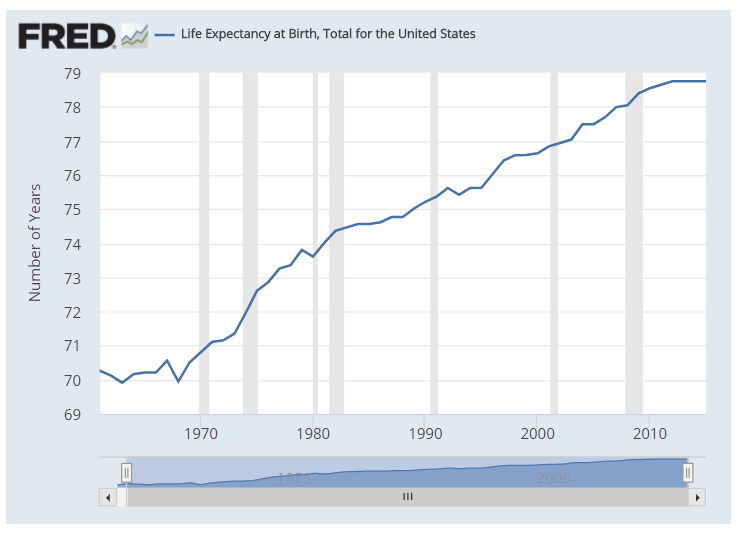

- People are living longer

Employees are Stressed about Finances

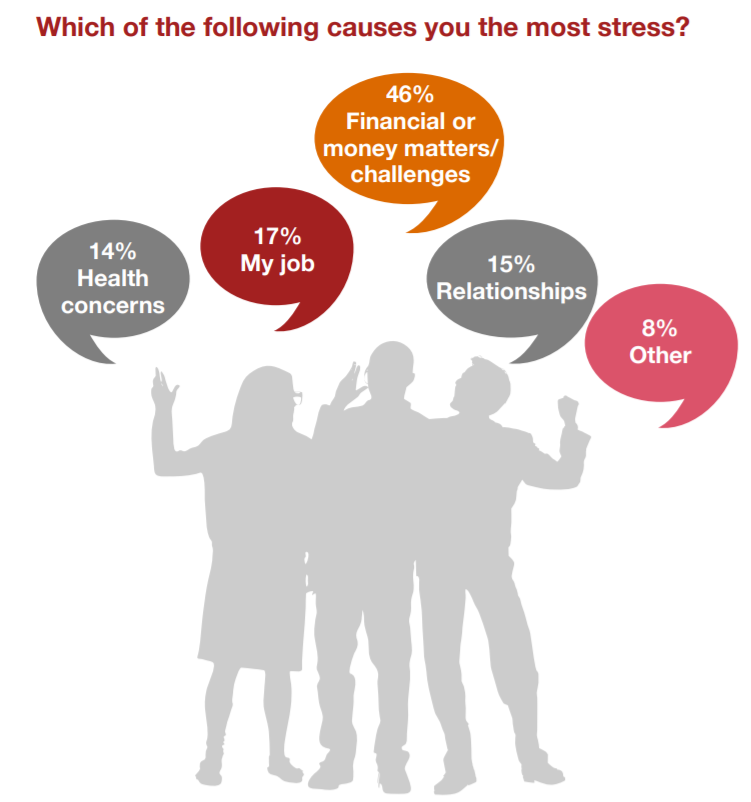

Obviously, the retirement crisis is enough to scare just about anyone. But, there’s more to the issue of saving than planning for retirement, and employees have wide-ranging concerns when it comes to their personal finances.

According to the 2017 Employee Financial Wellness Survey, here are a few of the concerns employees have3:

- Not having enough saved to cover emergencies/unexpected expenses (about 50% of surveyed employees)

- Not being able to meet monthly expenses (29% of surveyed employees)

- Not being able to keep up with debts (17% of surveyed employees)

In addition, 42% of employees found it hard to meet monthly household expenses, and nearly 60% of employees consistently carried a balance on one or more credit cards.3

Unfortunately, the stress employees feel about their ability to save, manage their expenses, and retire not only affects them, but it also affects their employers.

Indeed, 30% of employees admit that concerns about finances have distracted them at work and some have even missed work due to problems with their finances.3 Of course, financial stress also has the potential to impact employee health, which can drive healthcare costs up for employers.

The lesson to be learned?

Employers will benefit from helping their workers to be better savers.

Fortunately, there are a few excellent ways to help your employees be better at saving, and they don’t require a significant capital investment. In fact, they can be easily worked into your benefits program immediately.

Top Ways to Help Employees Save

Business Insider released 7 strategies4 that employers can use to help their employees be better at saving. We’ve added some tips to the best ones.

1. 12-Month Auto-Increase Savings Challenge

What to do: Chances are you already offer your employees a 401k. Host a workplace challenge for one year. During that year, have employees agree to a 1% increase in the amount they contribute each month (of course, this could be higher if you prefer). Then, automate the increases, so employees don’t forget to make the adjustment.

Why it works: Saving is hard, and according to an article that appeared in the Harvard Business Review, if people aren’t thinking about saving, then they probably won’t save. Automating savings helps ensure your employees are actually saving.5

Extra perks: Employees are more likely to have what they need going into retirement if they continually increase the amount they save. The reality is—most contribution rates set by retirement and savings accounts are too low. Without having employees increase the amount they contribute, it’s unlikely that they will remain on track with their savings, and most will not be comfortable when they retire.

2. Offer a Financial Wellness Program

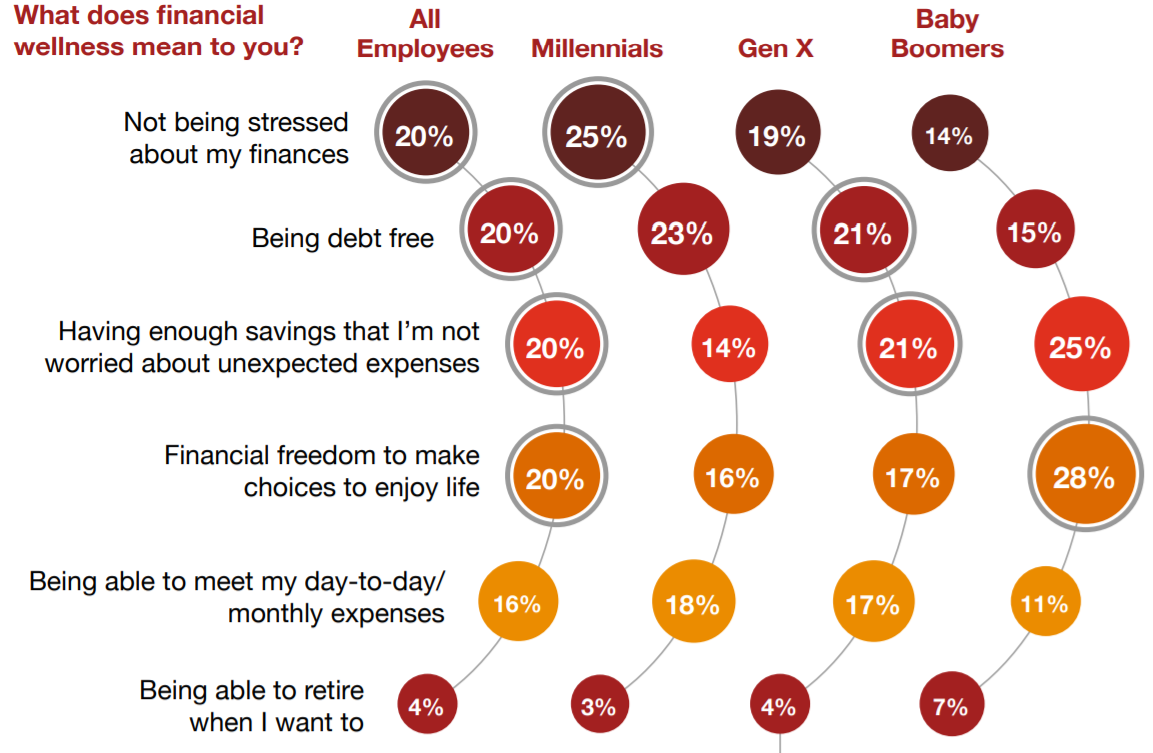

Financial wellness programs, and related benefits such as student loan assistance, are hot right now, and they’ll probably only become more important over time. So, if you want to help your employees save, teach them how. As the proverb goes, “give a man a fish and you’ll feed him for a day; teach a man to fish and you’ll feed him for a lifetime.”

If you’re wondering what to include in a financial wellness program, consider what employees want—or what financial wellness means to them. The chart below illustrates how employees define financial wellness, and it’s broken down by generation to make it easier for you to address the diverse needs that exist in your workplace.

3. Host a Seminar on EMOTIONALLY-DRIVEN Debt Pay Off Strategies

When faced with debt, the logical approach is to begin paying off loans according to their interest rate, monthly payment amount, or some other figure—the idea being to pay less to the institutions you owe. However, debt is emotional. And, many people find it harder to be successful following a logical approach. So, get “radical” and offer a better solution to your employees. After all, the less debt they have, they more they can save.

Why it works: According to professors at Northwestern University’s Kellogg School of Management, getting out of debt is about changing behavior, not math.6 Their research showed that those who paid off their debt by tackling their smallest loans first, working up to the biggest loans, were more likely to finish paying off all their debt—even compared to those who had already paid a large proportion of their debt off already. Basically, it’s about psychology and emotion. By tackling smaller debts first, you gain a positive momentum and you see results (and benefits) immediately. The experience and momentum propel you to successfully tackle larger loans.

What to do: You can either teach your employees how to organize their debt and pay them off in a snowball format—hitting the smallest ones first, or you can acquire materials from Dave Ramsey’s website, the man who is credited for this style of debt repayment.

4. Automatic 401k Enrollment Upon Hiring

Instead of handing employees a packet of paper, among which are the enrollment forms for your 401K, when they’re hired, automatically enroll employees in your 401K program. They can always request to opt out later, but at least they don’t hurt themselves by putting off enrollment for too long.

Why it works: This strategy works for the same reason that automatic increases in savings account contributions works—if the process is automated, and people don’t have to remember to do it, they’re more likely to do it.

5. Offer a Bonus to Any Employee Who Deposits Their Tax Refund or Company Bonus into Their 401k Account

Encourage employees to save large amounts of money when they can by making it more enticing to save. Once, the money is deposited into a 401K or other investment account, there’s usually a penalty for taking money out. So, you don’t need to worry about employees taking the bonus and then withdrawing the money.

Why it works: People don’t see bonuses and tax refunds the way they see their monthly paycheck. Consequently, they’re not as hesitant to direct the “extra” money to a savings account, and with an additional incentive to do so, the choice to save is even easier.

General Tips to Facilitate Savings Success

When implementing ways to help employees save, there are some overall principles worth considering. In general, any strategy you evoke to turn your employees into better savers should:

- Encourage present-oriented thinking so employees act now

- Feature some sort of consequence for not achieving goals

- Feature some sort of reward for goal achievement (preferably a reward that doesn’t involve spending money)

And, be sure to:

- Provide support for any strategies you implement. For example, you could connect employees to a budgeting expert, so they can see how a 1% increase in the amount they contribute to their retirement account will affect their monthly take home pay—the goal being to develop an understanding of the impact increased contributions have on monthly budgets, so the employee can plan accordingly.

- Have employees set SMART goals—goals that are specific, measurable, achievable, realistic, and time-limited.

Partner with a Reliable Source of Information and Support

Employers are now faced with the challenge of helping their employees manage their money and save for their future. But, who’s helping employers tackle this job? Thebest way to show employee appreciation is to make sure that you have the support you need. Partner with a reliable benefits administrator and get that support. Not only do they help with HSA admin, offering revolutionary HSA solutions, but they also help with payroll administration and more, which is perfect when it comes to working with employees on their 401k contributions and saving behavior.

Sources:

- https://www.jackson.com/financialfreedomstudio/articles/2018/01/americas-retirement-savings-crisis.html

- https://www.jackson.com/financialfreedomstudio/articles/2018/01/americas-retirement-savings-crisis.html

- https://www.pwc.com/us/en/private-company-services/publications/assets/pwc-2017-employee-wellness-survey.pdf

- http://www.businessinsider.com/7-research-backed-ways-to-save-more-money-with-less-effort-2018-1/#7-track-your-spending-7

- https://hbr.org/2017/12/how-digital-tools-and-behavioral-economics-will-save-retirement

- https://www.daveramsey.com/blog/scientists-say-the-debt-snowball-method-works