Nearly 60% of employees aren’t prepared to cover an unexpected healthcare cost. However, health savings accounts (HSAs) are helping to change that. As healthcare costs skyrocket, HSAs are becoming a more appealing option for many employees. High-deductible health plan and health savings account enrollment reached 21 million members in 2017 and is expected to continue to climb.

HSAs help employees afford HDHP deductibles as they increase. For example, the average HDHP deductible for single coverage in 2016 was $1,478 – a 12% increase over the previous year.

HSAs may be becoming more popular, but because of their complexity and lack of education from employers, many employees are still not enrolling in or taking full advantage of this benefit.

Employers can help change this through proper communication, calls to action, and utilizing the resources that employees’ value the most and will most likely impact their decisions.

Employees value proper communications and previous account experience when deciding whether to enroll in an HSA or not. Previous experience with an HSA allows employees to understand the benefits much more thoroughly than those who have not enrolled in one before. Continue reading our HSA guide for HSA enrollment tips.

Use Persuasive Communication

HSAs can be complicated without the proper foundation of knowledge, so communication is crucial. Using facts, persuasive language, hard numbers, and providing a simple, easy-to-execute call-to-action can significantly increase enrollment.

1. Be specific

Give your employees actual numbers to help them understand exactly how much money they will likely pay for healthcare and how much they could save on taxes by making HSA contributions. For example, the average annual health care cost per person in 2016 was $10,345. And in that same year, the average American family spent 10.1% of its income on health insurance premiums and deductibles, up from 6.5% a decade before.

Provide an HSA calculator for employees to see the exact amount of money they could be saving. Real numbers are concrete and persuasive.

You can also use relatable real-life—or made-up—examples to help employees connect with the information.

2. Go negative

Once your employees know how much money is on the line, remind them that it’s theirs to lose without an HSA. Describe their HSA tax savings as something that already belongs to them and can be lost without enrolling.

3. Create a path to action

Once your employees are properly motivated, ensure they have a simple way to enroll in an HSA. Provide bulleted instructions with links to take immediate action.

Reach Out During Open Enrollment and Beyond

Employees can enroll in and contribute to HSAs any time of year, not just around open enrollment. So be sure to reach out consistently to get them motivated when they’re most likely to follow through. One way to do this is to create a corporate alert system that distributes messages that employees have to read and click before proceeding with their workday.

Another tactic would be to build interruptions into the enrollment system, so instead of clicking a simple “Yes” or “No” box, employees have to check a box that says “I realize I am forfeiting this cost-saving benefit” in order to continue.

Employee education has to be an ongoing endeavor to turn positive results. Provide them with basic information whenever possible, update them on new information, and give them multiple opportunities to enroll in or contribute to their account throughout the year.

Choose the Right Option

There are three main types of tax advantaged spending accounts: HSAs, FSAs, and HRAs. HRA restrictions are largely determined by employers, FSAs are sponsored by employers, and HSAs are owned by each individual employee. HSAs give employees the most freedom and allow their money to roll over from year-to-year with no limits, unlike FSAs. And the money accumulated belongs to the employee, unlike an HRA.

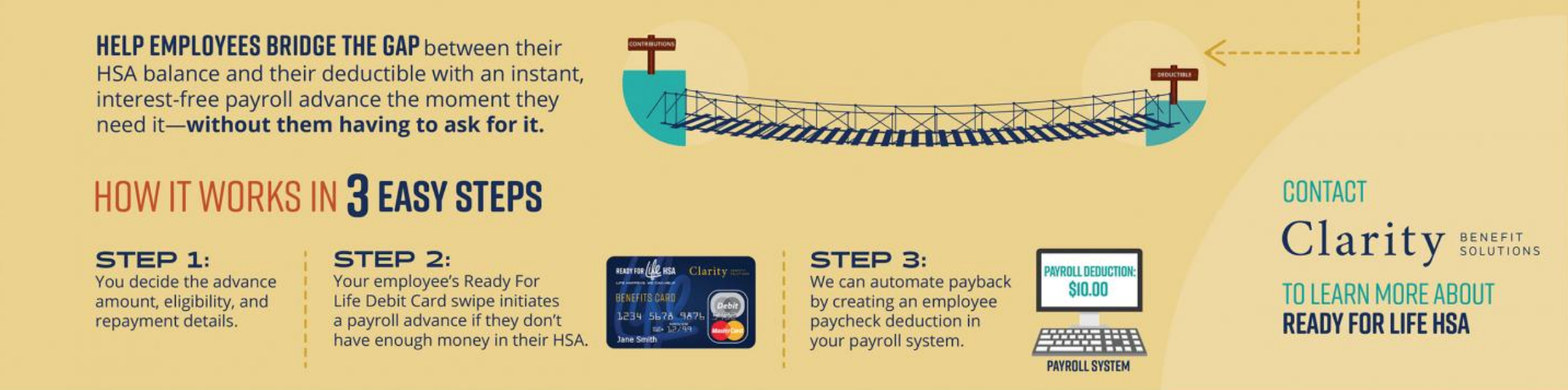

Clarity offers a Ready For Life HSA to give your employees with high deductible plans even more freedom. Employers can set a contribution limit for their employees, but the account itself belongs to the employee and does not require any further employer interaction. Employees receive their tax-free contributions each pay period and can use their Ready for Life Debit Card whenever they have a medical expense.

Both Ready For Life HSAs and standard HSAs offer tax-free contributions, earnings, and distributions, year-after-year roll over, job-to-job portability, and easy contributions withdrawals. However, only Ready For Life includes a built-in payroll advance for unexpected expenses. Ready For Life makes HSAs more attractive to employees and makes HDHPs easier for your company to adopt, it also helps you show employees that your company goes above and beyond the expected, and it relieves their financial stress, helping them stay focused and productive at work.

Contact Clarity Benefit Solutions or visit our Ready For Life HSA page to learn more about HSAs and find out if Ready for Life is right for your company.

Sources:

1. https://claritybenefitsolutions.com/rfl-hsa-employers

3. https://www.connectyourcare.com/tools/faqs/health-savings-account-faqs/