What's the difference between an HMO and a PPO?

What is HMO and PPO? Both HMOs and PPOs are considered managed healthcare insurance plans. But, their differences are what you need to pay attention to when deciding which is better, HMO or PPO, for your company.

The differences between HMO and PPO insurance plans are most notable when looking at network size, the ability to see specialists, and coverage for out-of-network services.

So is HMO or PPO better? The HMO and PPO difference is that it depends on network size, ability to see specialists, and out-of-network coverage.

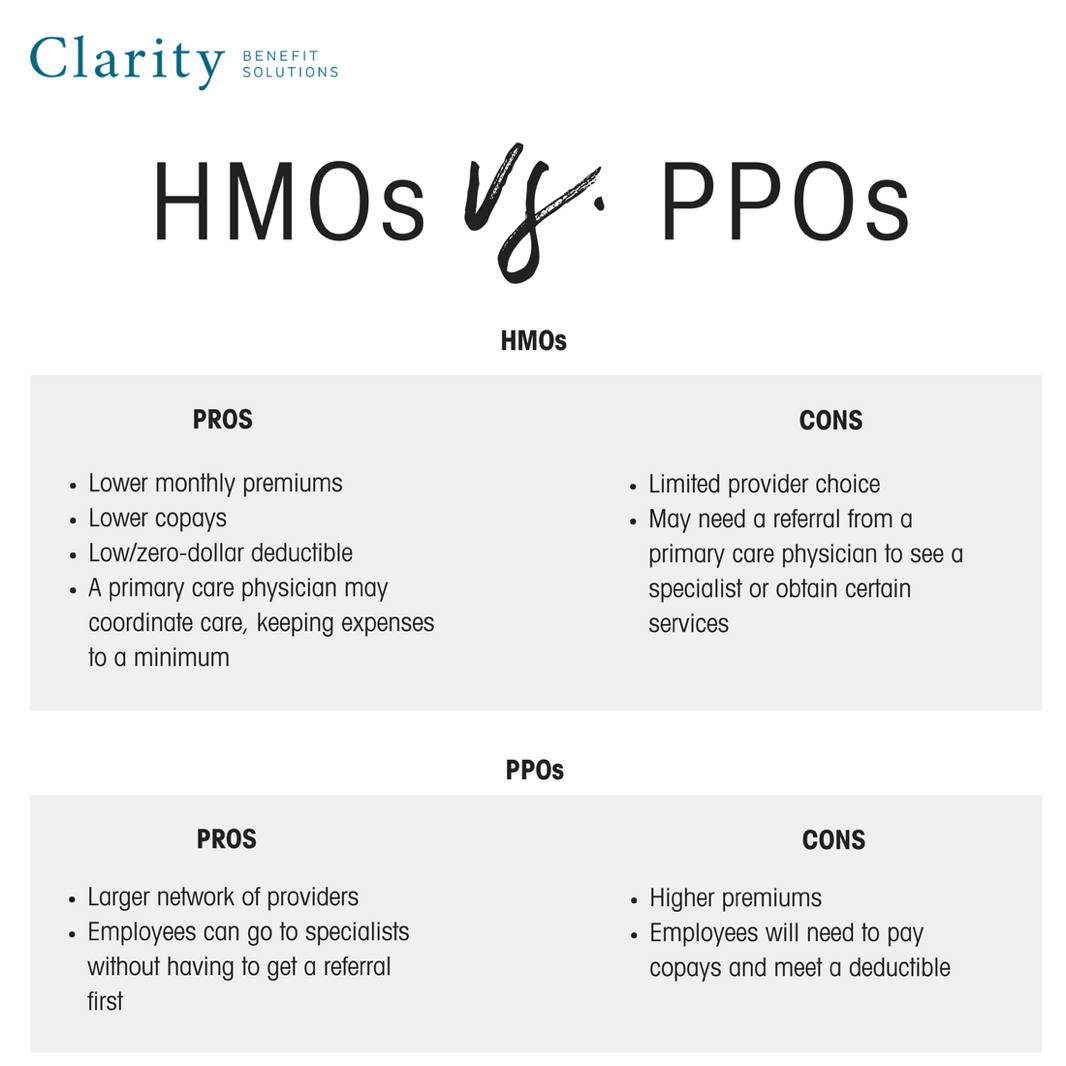

HMO Advantages and Disadvantages

HMO networks are smaller than PPO networks. This means that if you select an HMO, your employees will be more limited when it comes to choosing a provider. It’s important to consider the fact that an HMO requires employees to cover 100% of the cost of a service in all cases except emergencies if they use an out-of-network provider. You’d also need to make sure your employees know they may need to select a primary care physician to get a referral to see a specialist or obtain certain services.

PPO Advantages and Disadvantages

PPO networks are larger than HMO networks, in part because employees gain some out-of-network coverage. To some degree, PPOs are more flexible. Employees can see an out-of-network provider and be covered, though they may need to pay more. Employees can also see a specialist without having to go through a primary care physician for a referral. Obviously, if employees want to keep their costs down, they should still choose in-network providers, even under a PPO.

Both plan types will connect your employees to a network of providers and a variety of plan options, so before deciding between the two types of plans, you should also consider the cost of each plan type.

HMO vs. PPO Cost

Cost of an HMO Plan

HMO plans tend to be cheaper than PPO plans. They have lower out-of-pocket costs and less expensive premiums. Employees will have a low deductible and depending on the type of HMO plan you choose, if you choose one, you may find that your employees don’t have a deductible. Though these cost-saving measures only apply to in-network providers. Under an HMO, employees would be responsible for 100% of any out-of-network non-emergency service they obtain.

Cost of a PPO Plan

PPOs will be more expensive. You and your employees will feel the higher expense in a few ways—you’ll pay a higher monthly premium and employees will have to meet a deductible before their insurance kicks in. One way to reduce premiums under a PPO plan is to select a PPO plan with a copay.

HMO vs. PPO Insurance Pros and Cons

If it seems like HMOs sacrifice choice for a cheaper bill and PPOs charge more to have freedom and flexibility, you’ve got the gist of what you can expect from these plans. But, let’s break it down some more.

Selecting HMO vs. PPO health insurance for your employees

Both plan types use a network of doctors, hospitals, and healthcare providers. If you can afford the higher premiums go with a PPO, your employees will appreciate the freedom of choice and ability to see a specialist without having to wait on a referral from their primary care doctor. However, if you want or need to save, an HMO is an excellent option. Just examine the network in your areas to make sure the providers will meet your needs and expectations.

Round Out Your Plan Offerings

After deciding between an HMO and PPO, make sure you are compliant with other benefits like commuter benefits. You can partner with a provider that offers commuter benefits administration to make managing this benefit easy. Learn more at Clarity Benefit Solutions commuter benefits. Adding revolutionary products like the Ready for Life HSA to your benefits line up is also a good idea.