According to the National Center for Health Statistics, “the portion of employees enrolled in HDHPs rose from 26.3% in 2011 to 39.3% in 2016.” It’s clear that high-deductible health plans are on the rise, and with them come health savings accounts—or HSAs.

These accounts give employees a lot of freedom, and allow them to pay for qualifying medical expenses with tax-free dollars. However, while the HSAs are growing in popularity, many employees still do not fully understand what they have to offer. As their employer, you can help educate your workers by discussing Health Savings Account (HSA) pros and cons while encouraging them to contribute more money to their HSAs so they can use them to their fullest extent.

The Pros

HSAs are the only triple-tax-advantaged vehicle in the whole tax code. After the age of 65, the accounts can even be used for non-health care-related expenses, but withdrawals will be taxable. HSAs allow 100% of unused funds to roll over year-after-year, and the longer your employees’ money is in the account, the more tax benefits they can receive. This makes an HSA the perfect safety net or long-term investment account—if used properly.

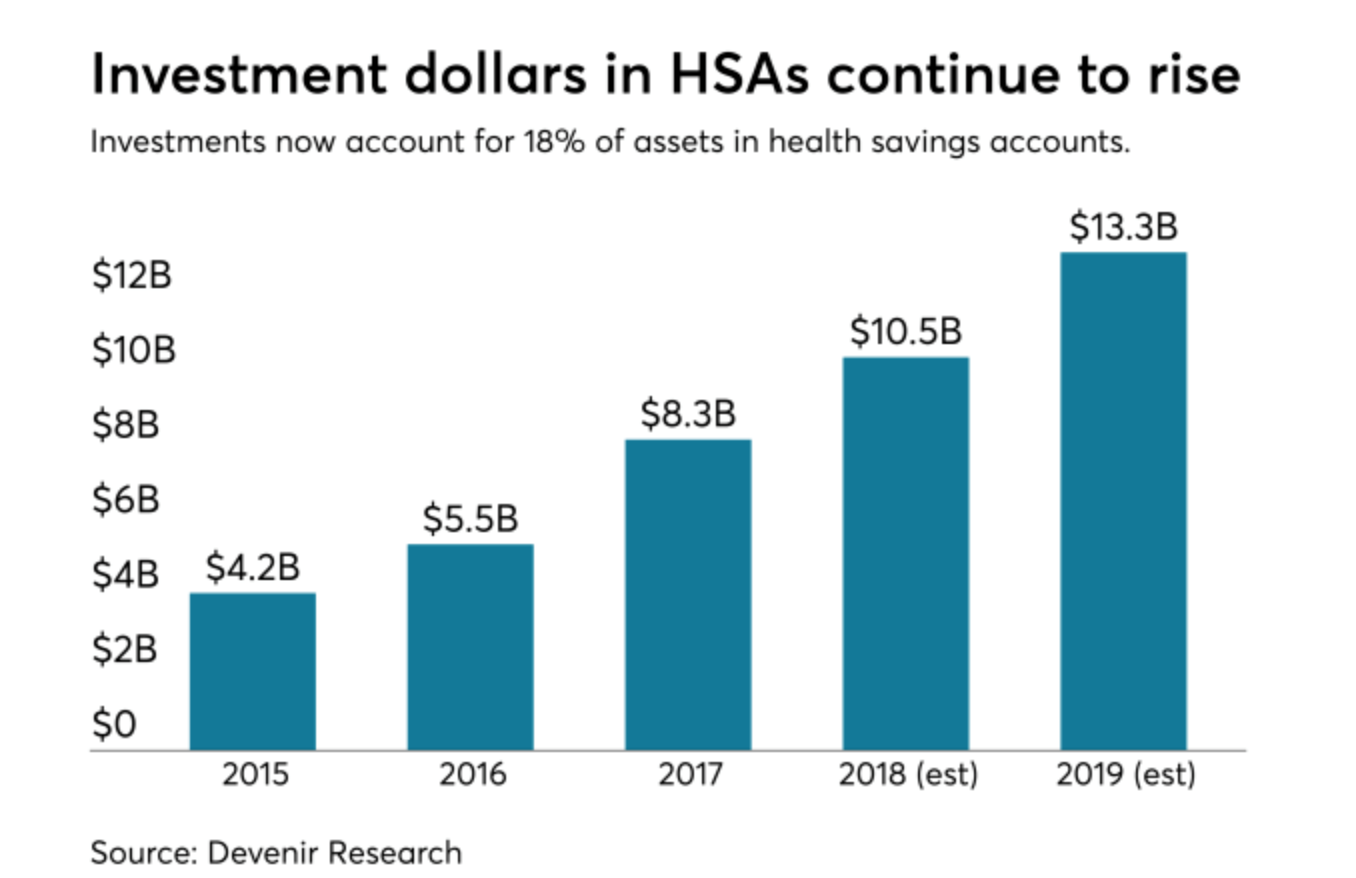

No wonder the investment dollars in HSAs have risen and are projected to continue rising over the coming years.

The Con(s)

Because HSAs can only be used with high-deductible health plans, employees have to understand that they will be required to pay more out-of-pocket for medical expenses.

Also, if an employee experiences a surprise medical expense and they don’t have enough saved in the HSA to cover the costs, they’ll need to turn to their savings account or a credit card to pay the leftover costs.

HSA Investment Tips and Important Trends

The growing popularity of HSAs is partially due to their potential as long-term investment accounts—and employers can encourage their employees to utilize them as such. In order to do this, it’s crucial that employees set aside the appropriate liquid reserves to cover all or some of their medical expenses while their HSAs grow. Many workers choose to utilize half their HSA as a savings account and the other half for medical expenses, to reap the reward of having untaxed savings as well as secure funds for health care.

Employers can start employees off on the right foot with some seed money. According to Willis Towers Watson’s 22nd Annual Best Practices in Health Care Employer Survey, about 62% of employers that offer HSAs are providing their employees with a head start by contributing seed money to the accounts. A small initial employer contribution can actually be a huge incentive.

Give employees real-world examples of how they could potentially use their HSA savings, and educate them about the specific advantages they offer to different groups of people. For example, the higher rate of divorce among older couples (50 and above) is leaving women in a cycle of financial abdication. Investing in their HSA can help women—married or un-married—plan for their future and take control over their financial decisions.

Lastly, communication and education are crucial. Provide employees with information about current trends, and decision support tools to help estimate tax effects, health care costs, and more—the more informed employees are, the more likely they are to contribute and invest in HSAs.

Why Choose Ready For Life

Ready For Life is a one-of-a-kind HSA with a built-in payroll advance to cover employees’ unexpected health care costs. It’s instant and automatic, so it requires minimal administrative work on your end and provides peace-of-mind for your employees.

The employer determines the advance amount, eligibility, and terms or repayment. When an employee experiences an emergency medical cost, Ready For Life kicks in with an instant, interest-free payroll advance funded by your company. The platform will automatically create an employee paycheck deduction system, eliminating any need for the employee to dig into their savings or use a credit card.

Because high-deductible health plans require higher out-of-pocket payments than other plans, a regular HSA may not be enough to help eliminate the financial pressure they pose. Ready For Life is a great option for employers who want to help give their employees that confidence and peace-of-mind, as well as make HSAs more appealing to them.

HSAs can seem complicated, especially when employees aren’t properly educated about them—which can cause some issues during open enrollment. But their popularity is growing, and employers who choose to adopt HDHPs and HSAs have to weigh the pros and cons and ensure their employees know exactly how they work before enrolling. To learn more about HSAs, Ready For Life, and how Clarity can simplify the open enrollment process, visit our website.

Sources:

2. https://claritybenefitsolutions.com/rfl-hsa-employers

3. https://www.nytimes.com/2017/10/13/your-money/health-savings-accounts.html