To help you stay compliant in a benefits landscape that is constantly changing, we’ve developed this HR compliance checklist. Use it as a guide to help you navigate the different steps you’ll need to take this year.

1. Double check your grandfathered status (if applicable)

If you had a plan when the ACA was enacted in 2010, and you have not made prohibited changes to it since then, you may have a grandfathered plan, and you may be exempt from some of the ACA’s mandates. Once you confirm the status of your plan, take the appropriate action:

• If your plan will lose its grandfathered status in 2018: Make sure your plan offers everything it’s required to provide under the ACA and address any shortcomings

• If your plan will maintain its grandfathered status in 2018: Give participants and beneficiaries a Notice of Grandfathered Status when providing them with information about plan benefits, plan summaries, open enrollment, and more

The U.S. Department of Labor Employee Benefits Security Administration provides answers to commonly asked questions as well as forms and templates. You’ll find answers about the language you’ll want to use in a Notice on their website.

2. Check your cost-sharing (out-of-pocket maximums)

This item applies to group health plans—insured and self-insured— that are not under grandfathered status.

The ACA limits the out-of-pocket maximum for essential health benefits to $7,350 (self-only coverage) and $14,700 (family coverage). These maximums are effective for plan years beginning on or after Jan 1, 2018.

You’ll want to make sure that your plan complies with the limits set for out-of-pocket maximums, keeping the various aspects that affect out-of-pocket maximums in mind (e.g., offering an HDHP paired with an HSA).

To fully address this item on the checklist, here are the major related tasks you’ll want to take care of:

• If you offer an HDHP-HSA: make sure your out-of-pocket maximum is lower than the ACA’s HDHP limit—specifically, $6,650 (for self-only coverage) and $13,300 (for family coverage)

• If you use multiple service providers: make sure all essential health benefit claims are coordinated across service providers

3. Go over your FSA contributions

In 2017, the amount an employee could contribution to a Flexible Spending Account (FSA) was capped at $2,600. In 2018 the limit is $2,650. Make sure your FSA prohibits employees from contributing more than the limit. Communicate all changes to employees.

For information about HRAs and compliance, reach out to a seasoned HRA company.

4. Start using the New Summary of Benefits and Coverage (SBC) Form

Regardless of whether your plan has an annual open enrollment period, you’ll need to start using the new SBC Form this year. If you have a self-funded plan, your plan administrator is responsible for creating and providing the SBC to employees. If you’re unsure of how to handle this aspect of compliance, speak with the person or company responsible for issuing your health plan.

5. Verify HIPPA compliance

Last fall the Department of Health and Human Services announced their decision to further examine the issue of HIPAA certification as it relates to ACA requirements. Until they come to a decision on the issue, it’s in your best interest to comply with electronic data interchange rules and keep an eye out for updates to HIPAA requirements.

6. Determine if you’re an ALE (Applicable Large Employer)

Despite recent changes to The Affordable Care Act, individuals are still required to have health insurance and companies with a certain number of full-time employees (or full-time equivalent employees) must still provide adequate and affordable health insurance. If there’s a possibility that your business was considered an ALE in 2017—either under ACA criteria or your state’s fully insured group health plan market—you’ll want to do the calculation now and determine whether you are in fact considered an ALE as penalties will likely begin to accrue as early as January.

According to the Employer Mandate, businesses are considered ALEs under the ACA if they have 50 or more full-time or full-time equivalent employees.

You can determine how many full-time and full-time equivalent employees you have using the following:

• Full-Time Employees: Any employee who works, on average, 30 or more hours each week every month or a minimum of 130 hours in a single month

• Full-Time Equivalent: The total number of hours worked by all part-time employees divided by 120

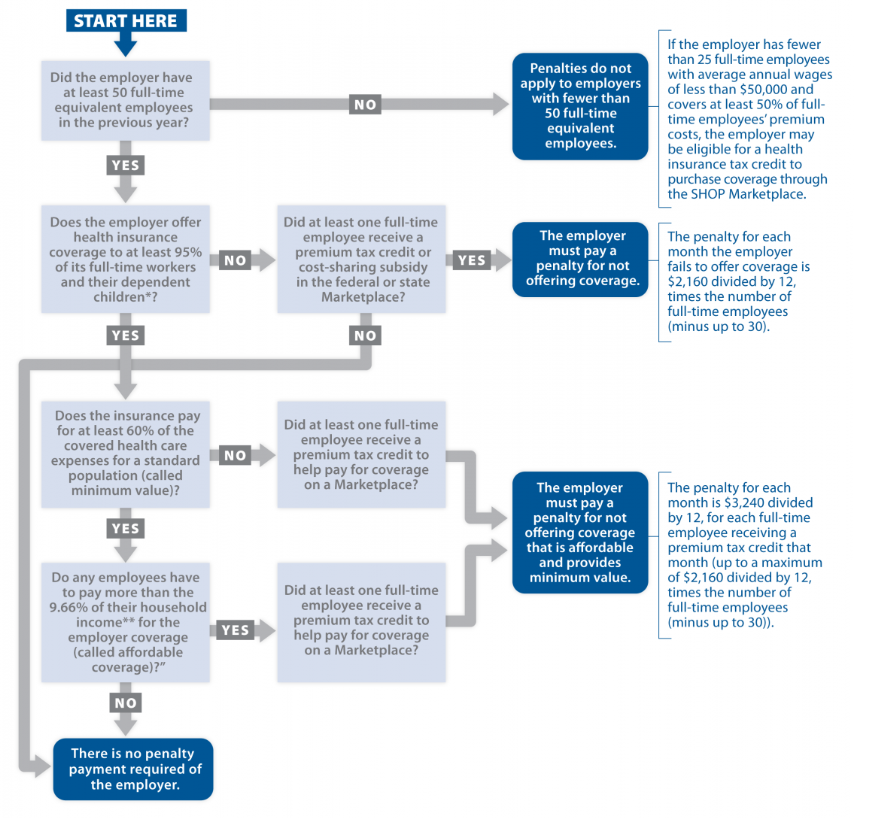

Add the number of full-time and full-time equivalent employees together to find your total number of full-time/full-time equivalent employees. If this number is 50 or greater, you’re considered an ALE under the ACA. Ideally, you provided coverage for your employees in 2017, but if you didn’t you’ll need to start planning to pay penalties and you’ll need to arrange for coverage. Employers can use the flowchart we’ve included below to determine their responsibilities and the potential penalties for not following through with them.

7. If you’re an ALE, report coverage to IRS

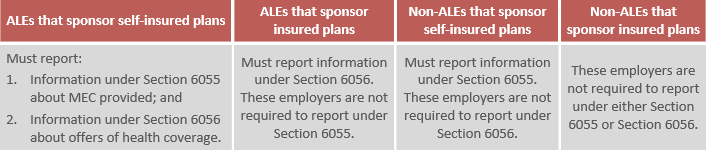

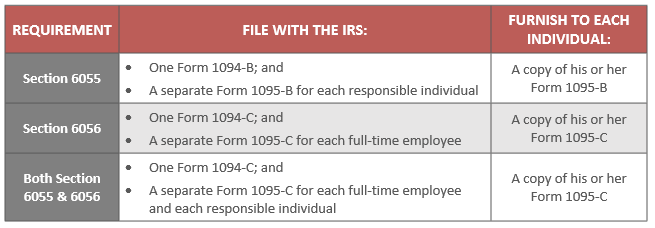

Start the filing process early so you have time to get it right. You’ll want to figure out which reporting requirements you need to complete, the information you’ll need to provide, and the forms you’ll use to submit the information. Here are two charts to facilitate this portion of the checklist:

Please note—if you will file 250 or more returns under either Section 6055 or Section 6056, you must file electronically.

8. Notify employees about the ACA’s Exchange

Employers are required to tell their employees about ACA’s health insurance Exchanges when they’re hired. You can use the Department of Labor’s template for Exchange notices to inform employees.

9. Update and distribute plan summary descriptions

Early in the new year is the time to update plan descriptions and disseminate information about changes. Updates you’ll want to look for/make include:

• Notice of special enrollment rights

• Information about qualifying events

• Marketplace exchange events

• Wellness program disclosures

• Procedures and orders for medical child support

If no changes were made, you don’t have to update plan descriptions this year. However, you may want to recirculate plan descriptions to stay top-of-mind amongst employees.

10.Keep Records

Lastly, get informed about record keeping rules and make sure you’re storing and filing information properly. If you need help, ask your benefits administrator for guidance.

Check-in with a Reliable Benefits Administrator

Like any hardworking HR manager, we know you want to get a jump start on compliance. We also know that managing benefits is a complex task. So, don’t hesitate to reach out to a reliable benefits administrator for help this year—even if it’s just to get a question answered here or there. Our mission is to make benefits easy and affordable—from health reimbursement account administration to innovative solutions and technology, we’re here for you.