HSA contribution limits will rise again in 2019.

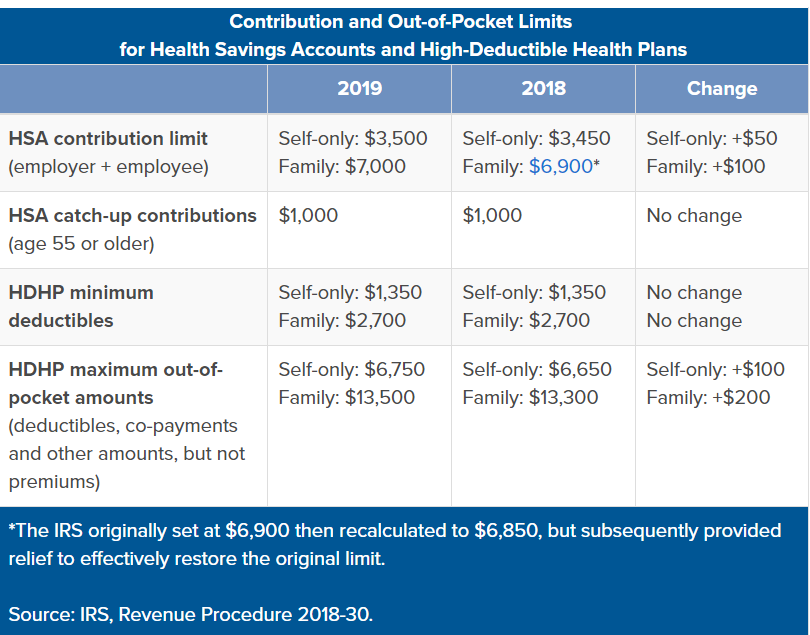

The chart below illustrates the changes that will go into effect.

Total contributions, regardless of who contributes (employee and/or employer), cannot exceed these maximum amounts.

Why These Limits?

The previous limit was set in response to inflation. However, feedback from major stakeholders caused the IRS to reinstate the prior limit.

The Chained Consumer Price Index (Chained CPI) was applied to HSA increases last year (as well as a host of other benefits; to learn more contact your broker or HSA company).

What employers need to know is this—

Chained CPI rises more slowly than the CPI that has been used in the past—in part because it assumes that consumers modify their purchasing behavior in accordance with price hikes.

Because Chained CPI makes this assumption, despite rises in inflation, the HSA limit for 2019 was set to decrease. However, in response to much concern, they determined it was in the best interest of taxpayers to revert back to the prior limit.

How Will the Limit Increases Impact Employers?

Employers are impacted every time there’s a new contribution limit. For 2019, here’s what you’re looking at—

First, if you make contributions, you may want to increase the amount you contribute. You don’t need to change how you contribute. Increasing your contributions when maximum contribution limits increase shows you help employees keep pace with inflation—something that has a small but non-insignificant effect on employee loyalty.

Second, you’ll need to familiarize yourself with how HDHPs will change. The HSA contribution limits were announced in conjunction with minimum deductible and maximum out-of-pocket expenses for HDHPs. Annual out-of-pocket maximums for HDHPs will rise to $6,750 for self-only plans (a $100 increase) and $13,500 for family plans (a $200 increase).*

Third, you’ll need to let employees know about the new HSA limits so that they can adjust accordingly.

Fourth, if chained CPI continues to be applied, you should begin to expect HSA contribution limits to increase more slowly in future years.

What Adjustments Can Employers Make?

The IRS announced the new HSA contribution limits on May 10th. So, the good news is that you have plenty of time to prepare as the new limits won’t go into effect until the 2019 calendar year.

But for proactive employers looking to get head…

The single best thing you can do is offer a better HSA.

Unfortunately, the increased limits aren’t going to do much in the way of helping employees cover unexpected medical expenses. It’s better to help them find other ways to stay afloat and healthy.

We’ve created the Ready For Life HSA to address the gap between what employees have saved in their HSAs and what they owe. If employees haven’t reached their deductible or out-of-pocket-max and they haven’t saved enough in their HSA to cover their expenses, Ready For Life kicks in with an automated and interest free payroll advance that gets the employee through their rough patch. This means that your employee won’t need to go into debt to take care of themselves or their family.

The bottom line is that most employees have less than $1,000 in their savings account.1 So, it’s unrealistic to expect that they will have enough saved to meet their deductible or out-of-pocket maximums. And, with HSA limits at what they are (and will be), most employees are still going to have a gap between what they’ve saved in their HSA and what they owe when they incur an unexpected medical expense. You can help them manage this situation by offering a better HSA.

Visit our Ready For Life page to learn more.

Partner Up for 2019

Getting ready for 2019 starts now. Make 2019 your best benefits year yet by partnering with the right support network. Clarity offers health reimbursement account administration and more and is dedicated to helping employers make the best benefits decisions possible for their employees and their bottom line.

*ACA compliance regulation amounts may differ, so it’s important to confer with your broker or HRA company.

Sources:

https://www.marketwatch.com/story/most-americans-have-less-than-1000-in-savings-2015-10-06